globally also contributed to the TDMA revenue declines. In 2002, we continued to experience significant pricing pressures on our TDMA

technologies in the U.S. resulting from the increased competition for customers. TDMA revenues continued to be a smaller portion of Wireless

Networks in 2002 compared to 2001.

GSM revenues declined substantially in 2002 compared to 2001 due to substantial declines in Asia Pacific and EMEA. These substantial

declines were primarily due to a continued deterioration in wireless service providers’ financial condition and slower subscriber growth, and

delays in capital expenditures. Also in Asia Pacific, customers began to deploy CDMA technology solutions as they migrated away from the

maturing GSM technologies. This shift in technology focus contributed to the substantial decline in GSM revenues in Asia Pacific.

In 2002, UMTS revenues continued to be an insignificant portion of overall Wireless Networks revenues. While the first commercial launches

in the industry did take place in EMEA and Asia Pacific, technology issues associated with third generation, or 3G, handsets contributed to

delays in larger deployments of 3G networks in 2002. Also, some of our 3G customers in EMEA incurred significant costs in 2002 associated

with licensing fees, which, along with their continued focus on improving their financial performance, limited their spending on network

deployments. As a result, 3G network deployments suffered delays in EMEA in 2002.

From a geographic perspective, the 27% decline in Wireless Networks revenues in 2002 compared to 2001 was primarily due to a 54% decline

in revenues in Asia Pacific, a 16% decline in revenues in the U.S., a 25% decline in revenues in EMEA and a 27% decline in revenues in

CALA. The declines in all regions were mainly due to the continued deterioration in wireless service providers’ financial condition and

subscriber growth and increased competition for customers by service providers which resulted in the decision of many wireless service

providers to delay capital expenditures.

During 2003 and 2004, Wireless Networks revenues continued to be primarily generated by sales of CDMA and GSM technologies. Also,

revenues associated with our TDMA technology continued to decline in 2004 compared to 2003 due to the continued transition to newer

wireless technologies. Regarding our UMTS technology, revenues have grown compared to 2003 as a result of contracts announced in the

second half of 2003 and in 2004 and the continued transition to this next generation technology. We expect a growing percentage of our

Wireless Networks revenues to come from our UMTS technology. While we have seen encouraging indicators in certain areas of the wireless

market, we can provide no assurance that these growth areas that have begun to emerge will continue in the future.

Enterprise Networks revenues

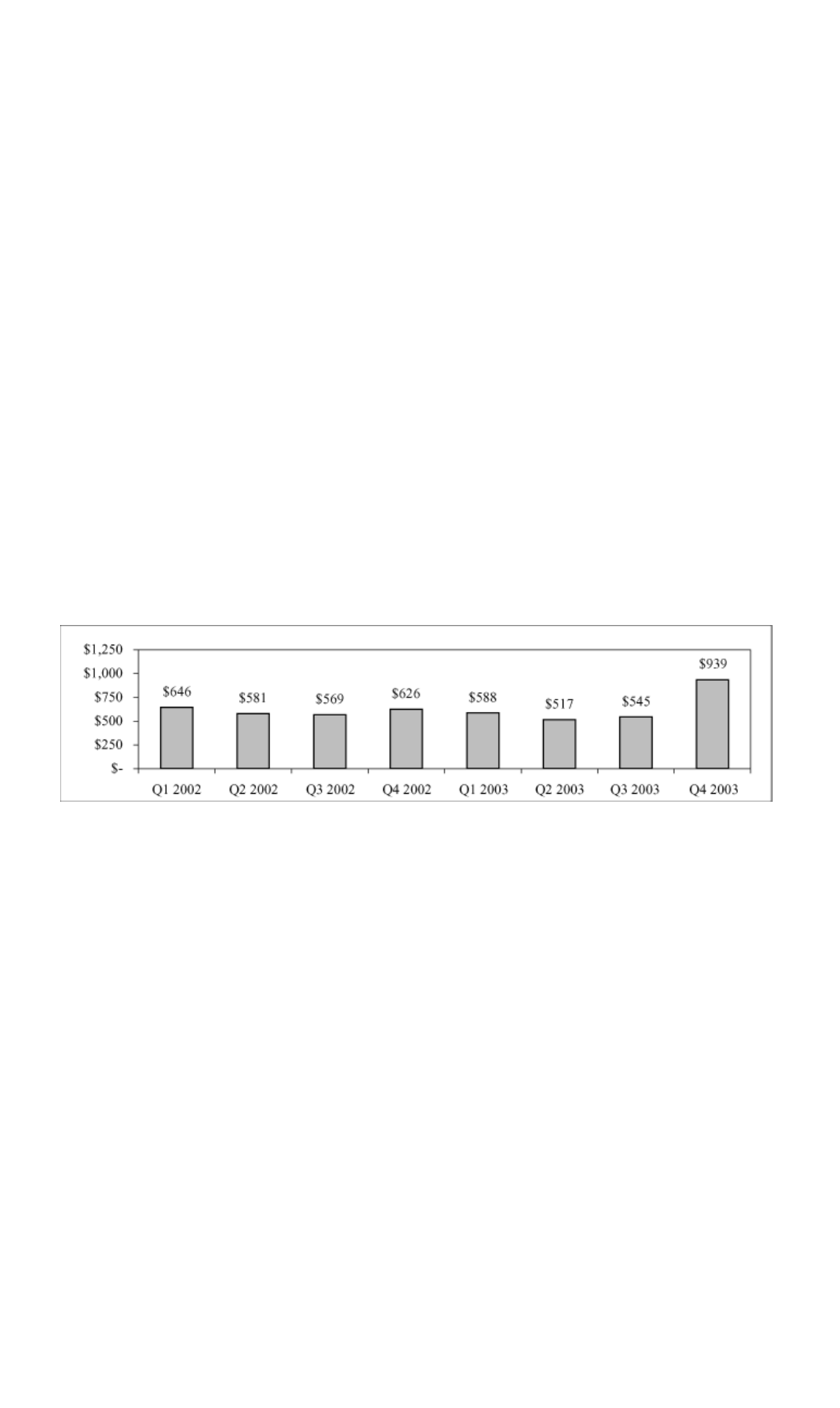

The following chart summarizes recent quarterly revenues for Enterprise Networks:

Enterprise Networks revenues increased 7% in 2003 compared to 2002 due to a substantial increase in the circuit and packet voice portion of

this segment offset by a significant decrease in the data networking and security portion of this segment.

Revenues from the circuit and packet voice portion of this segment increased substantially in 2003 compared to 2002. We experienced a

substantial increase in revenues associated with our traditional circuit switching and interactive voice response products primarily due to the

release of certain software including Succession 3.0. The general availability of this software in the fourth quarter of 2003 triggered the

recognition of associated revenues deferred from prior periods, resulting in a net

58

2004 and 2005

2003 vs. 2002