Consolidated Statement of Operations data for the nine months ended September 30, 2003

Revenues and cost of revenues were impacted by various errors related to revenue recognition, corrections to foreign exchange accounting,

intercompany related items, special charges and other adjustments, including financial statement reclassifications. The net impact to revenues

of the adjustments was a decrease of $79, a decrease of $53 and an increase of $78 for the first, second and third quarters of 2003, respectively.

The net impact to cost of revenues related to these revenue adjustments, and the other corrections, was an increase of $70, $93 and $140 for the

first, second, and third quarters of 2003, respectively. The Second Restatement adjustments to revenues and cost of revenues in each of these

periods related primarily to the following items:

As part of the plan to address a material weakness reported in our Quarterly Report on Form 10-Q for the period ended September 30, 2003, a

review of foreign exchange accounting was undertaken. The net impact to pre-tax loss was a decrease of $91 and $15, and an increase of $8 for

the first, second, and third quarters of 2003, respectively. The significant items were as follows:

47

As

previously

re

p

orted Ad

j

ustments As restate

d

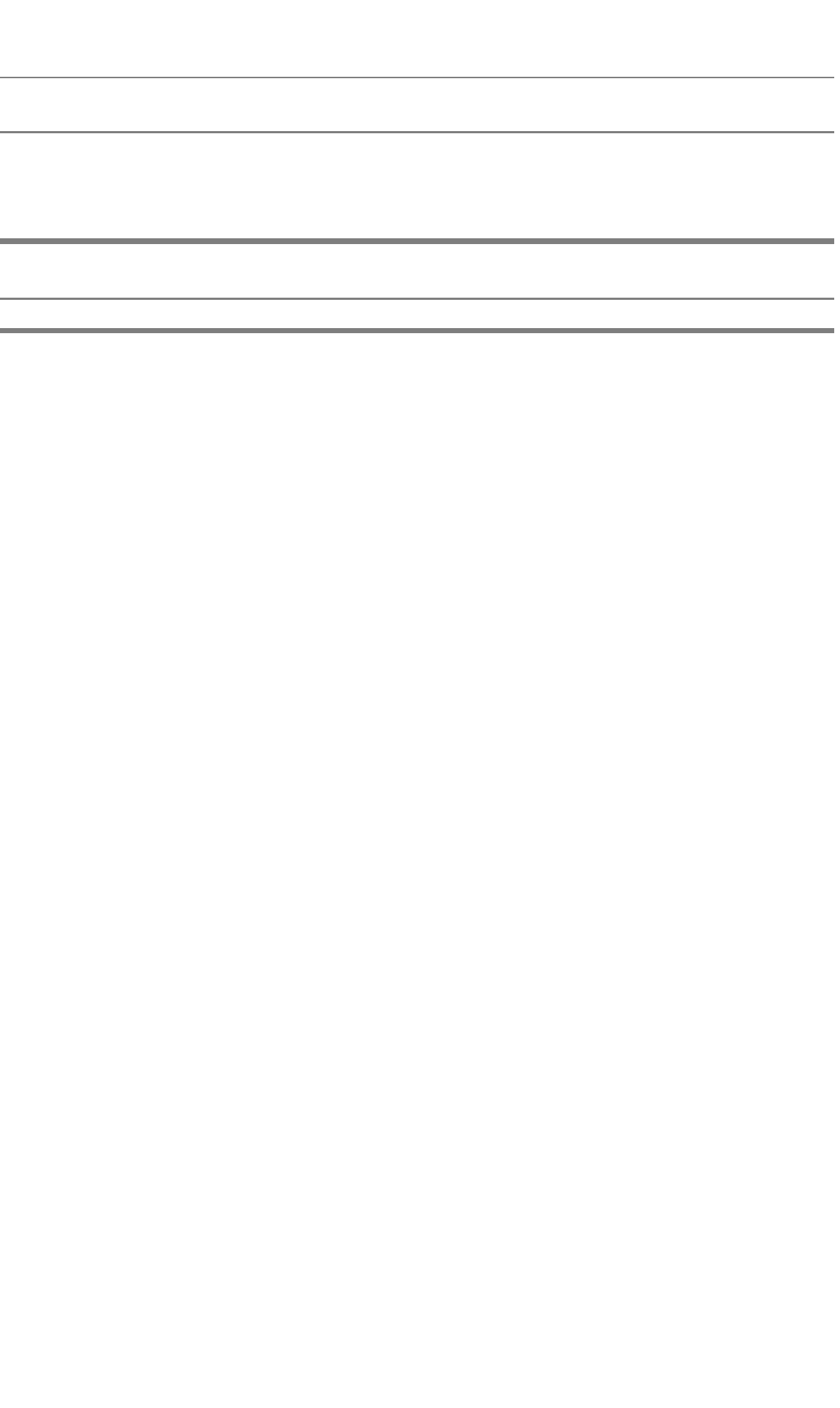

Revenues $ 6,981 $ (54) $ 6,927

Gross

p

rofit 3,264 (357) 2,907

Operating earnings (loss) 81 (378) (297)

Earnings (loss) from continuing operations before income taxes, minority interests and equity in net loss of associated companies 64 (217) (153)

Net earnings (loss) from continuing operations (3) (236) (239)

Net earnings (loss) from discontinued operations — net of tax 244 (87) 157

Net earnings (loss) 233 (327) (94)

Basic and diluted earnin

g

s (loss)

p

er common share

— from continuing operations $ 0.00 $ (0.06) $ (0.06)

— from discontinued operations 0.05 (0.01) 0.04

Basic and diluted earnings (loss) per common share $ 0.05 $ (0.07) $ (0.02)

R

evenues and cost o

f

revenues

• incorrect application of SAB 104 or SOP 97-2, the most significant of which related to revenue that should have been deferred until

title or risk of loss had passed, or products had been delivered;

• incorrect application of AICPA SOP 81-1, Accounting for Performance of Construction-Type and Certain Production-Type

Contracts, or SOP 81-1, with respect to percentage-of-completion accounting for certain long-term constructions contracts; an

d

• various other adjustments, primarily related to specific contracts and transactions, including two transactions recorded in the first

quarter of 2003 which should have been recorded in 2002.

F

orei

g

nexchan

g

e

• we re-examined the determination of the functional currency for certain entities based on the guidance under SFAS No. 52. As a

result, we identified four instances in which the functional currency designation of an entity was incorrect. These revisions resulted

in increases or decreases to other income (expense)

—

net;

• we identified two instances of incorrect treatment of significant intercompany positions. The net impact of the adjustments was an

increase or decrease to other income (expense)

—

net, with an offset to accumulated other comprehensive loss; and

• we identified errors in the revaluation of certain foreign denominated customer financing provisions within discontinued operations,

which increased other income and decreased net earnings from discontinued operations.