F-28

Discontinued operations

As a result of the restatement process, the initial provision for loss on disposal of the access solutions discontinued operations recorded in

June 2001, and the subsequent activity during 2001 through 2004 were re-examined. Nortel Networks concluded that the net loss on

disposal of operations recognized in the second quarter of 2001 was overstated. In addition, other adjustments were necessary to correct

certain items that were either initially recorded incorrectly, or not properly released or adjusted for changes in estimates in the appropriate

periods subsequent to the second quarter of 2001. The net impact of all of these changes was an increase of $121 and a decrease of $529

to net loss from discontinued operations — net of tax for the years ended December 31, 2002 and 2001, respectively, as follows:

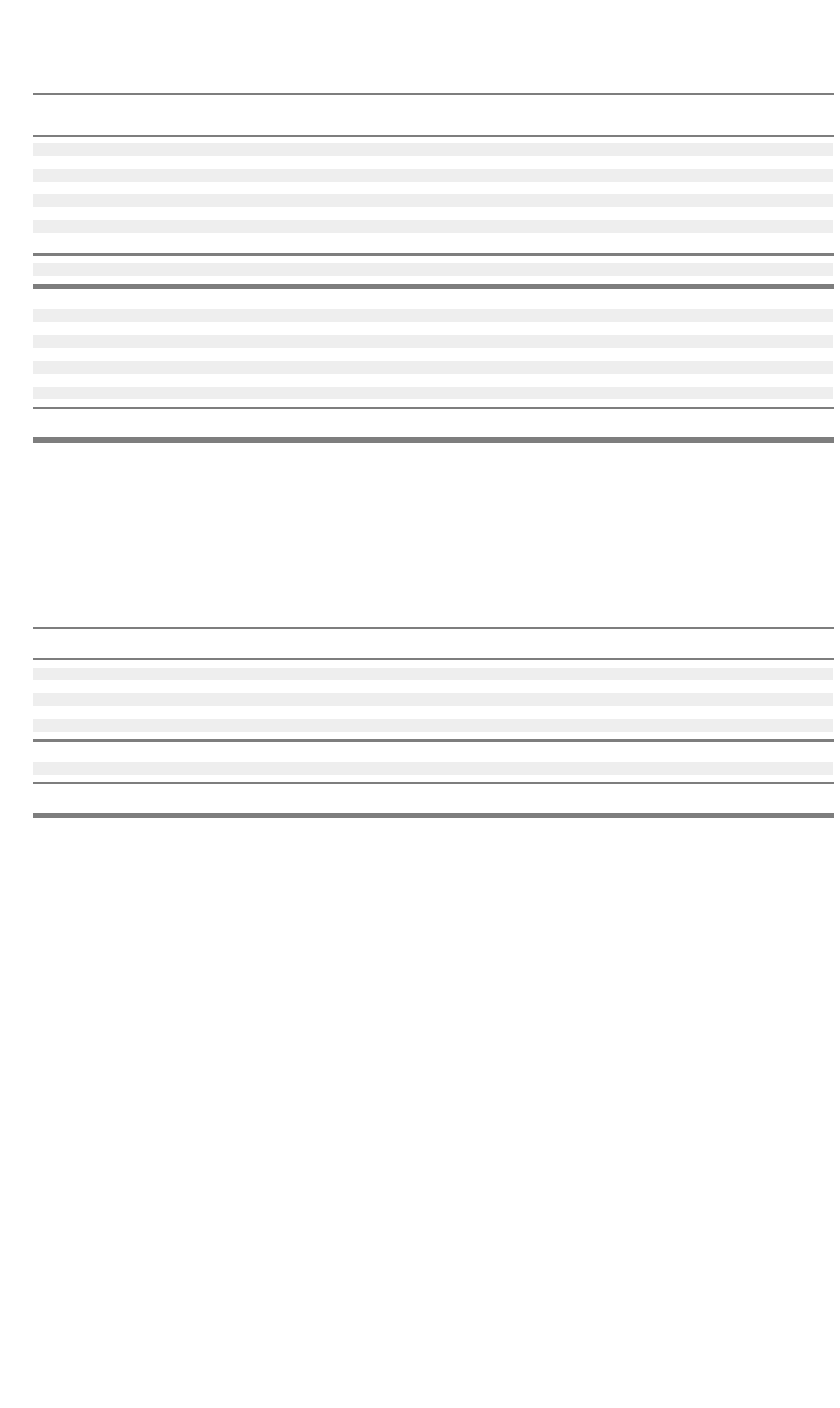

D

ecrease to net loss on disposal of operations — net of tax

The components of the decrease to the initial loss on disposal of operations recorded in the second quarter of 2001 were as follows:

Royalty Disposal Minority

expense of assets interests Other Total

2002 Reclassifications

Cost of revenues $ 49 $ 7 $ – $ (10) $ 46

Selling, general and administrative expense – – – 33 33

Research and development expense – – – (22) (22)

Deferred stock option compensation – – – (1) (1)

(Gain) loss on sale of businesses and assets – 38 – – 38

Other expense (49) (45) (21) – (115)

Minority interests — net of tax – – 21 – 21

Net impact of reclassifications $ – $ – $ – $ – $

–

2001 Reclassifications

Cost of revenues $ 59 $ (20) $ – $ 1 $ 40

Selling, general and administrative expense – – – (12) (12)

Research and development expense – – – (5) (5)

Deferred stock option compensation – – – 16 16

(Gain) loss on sale of businesses and assets – 29 – – 29

Other expense (59) (9) (22) – (90)

Minority interests — net of tax – – 22 – 22

Net impact of reclassifications $ – $ – $ – $ – $

–

2002 2001

Decrease to net loss on dis

p

osal of o

p

erations

Items that should have been charged to continuing operations $–$520

Overstatement of accruals – 438

Investment impairments –41

Taxeffectontheabove – (261)

Decrease to net loss on disposal of operations — net of tax –738

Other adjustments (121) (209)

Decrease (increase) to the net loss from discontinued operations — net of tax $ (121) $ 529

• a $520 decrease for contingent liabilities and customer financing provisions that should have been charged to continuing operations

rather than discontinued operations;

• a $438 decrease to accruals for contingent liabilities and for other contingencies that did not meet the definition of a liability under

SFAS No. 5, “Accounting for Contingencies”, when initially recorded;

• a $41 decrease for investment impairments that should have been charged to the net loss from discontinued operations rather than

the net loss on disposal of operations; and

• the tax effect on the above of $261.