2003

153

41,999 of the stock options granted to Ms. Spradley in 2002 were granted pursuant to the voluntary stock option exchange program. All of those options were

exercisable as of December 31, 2004.

(7) As a result of the termination of Mr. Dunn’s employment for cause on April 27, 2004, all United States dollar and Canadian dollar options held by Mr. Dunn terminated

and expired automatically on April 27, 2004, including all performance accelerated stock options.

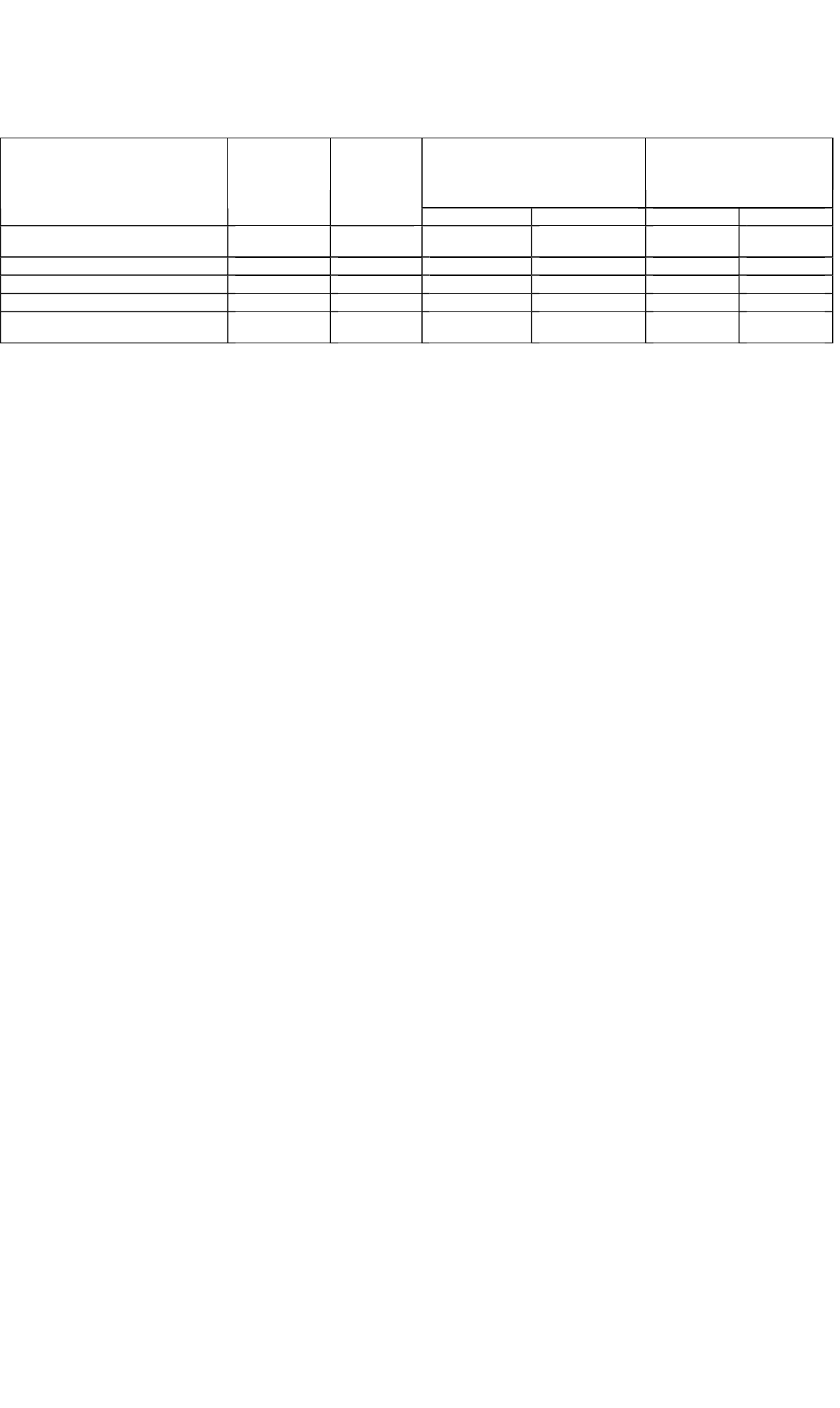

Number of Securities

Underlying

Unexercised Options at Fiscal

Year-End (#)(1)(2)(3)(4)

Common

Shares Acquired

On Exercise

(#)

Value of Unexercised

In-the-Money

Options at Fiscal Year-End ($)(4)

Value

Realized ($)

Name Exercisable Unexercisable Exercisable Unexercisable

F.A. Dunn –

–

–

–

750,000(Cdn) (5)(6) 1,500,000(Cdn)(5)

–(7)

– –

P. Debon – – 891,999 (6) 710,001 – –

S.L. Spradley – – 148,665 (8) 173,334(8) – –

C. Bolouri – – 931,332(Cdn) (6) 686,668(Cdn) – –

N.J. DeRoma – – 663,333(Cdn)

80,000

(6) 870,001(Cdn) – –

(1) As adjusted to reflect the two-for-one stock split of Nortel Networks Limited’s common shares effective at the close of business on January 7, 1998, the stock dividend of

one common share on each issued and outstanding common share of Nortel Networks Limited effective at the close of business on August 17, 1999, and the two-for-one

stock split of the Company’s common shares effective at the close of business on May 5, 2000, where applicable.

(2) Includes the following number of previously granted “replacement options”: 160,000 for Mr. Debon; 120,000 for Mr. Bolouri; and 160,000 for Mr. DeRoma. Mr. Dunn

had also been granted 120,000 replacement options, which he subsequently voluntarily returned for immediate cancellation in June 2003. See also footnotes (5) and

(7) below. Replacement options are granted pursuant to the Company’s key contributor stock option program. Under that program, a participant is granted concurrently an

equal number of initial options and replacement options. The initial options and the replacement options expire ten years from the date of grant. The initial options have an

exercise price equal to the market value of common shares of the Company on the date of grant and the replacement options have an exercise price equal to the market

value of common shares on the date all of the initial options are fully exercised, provided that in no event will the exercise price be less than the exercise price of the initial

options. Replacement options are generally exercisable commencing 36 months after the date all of the initial options are fully exercised, provided that the participant

beneficially owns a number of common shares at least equal to the number of common shares subject to the initial options less any common shares sold to pay for options

costs, applicable taxes, and brokerage costs associated with the exercise of the initial options.

(3) As the Company grants both United States dollar and Canadian dollar stock options, the options are listed separately for each currency, where applicable. Unless otherwise

stated, all options are United States dollar options.

(4) As at December 31, 2003, all of the outstanding exercisable or unexercisable United States dollar or Canadian dollar stock options held by the named executive officers

had an exercise price that exceeded the closing price of the Company’s common shares on the last trading day of the year on, respectively, the New York Stock Exchange

for United States stock options and on the Toronto Stock Exchange for Canadian stock options. On December 31, 2003, the closing price of the Company’s common shares

on the New York Stock Exchange and the Toronto Stock Exchange was $4.23 and Cdn$5.49, respectively. The weighted average exercise price of the outstanding

exercisable and unexercisable United States dollar and Canadian dollar stock options as at December 31, 2003 was: Cdn$8.95 for options held by Mr. Dunn; $14.51 for

options held by Mr. Debon; $6.30 for options held by Ms. Spradley; Cdn$37.06 for options held by Mr. Bolouri; and Cdn$25.18 for Mr. DeRoma’s Canadian dollar stock

options and $11.29 for his United States dollar stock options. Where applicable, weighted average price has been calculated assuming that replacement options that

currently do not have set exercise prices will have exercise prices equal to the exercise prices of the corresponding initial options. See footnote (2) above.