219

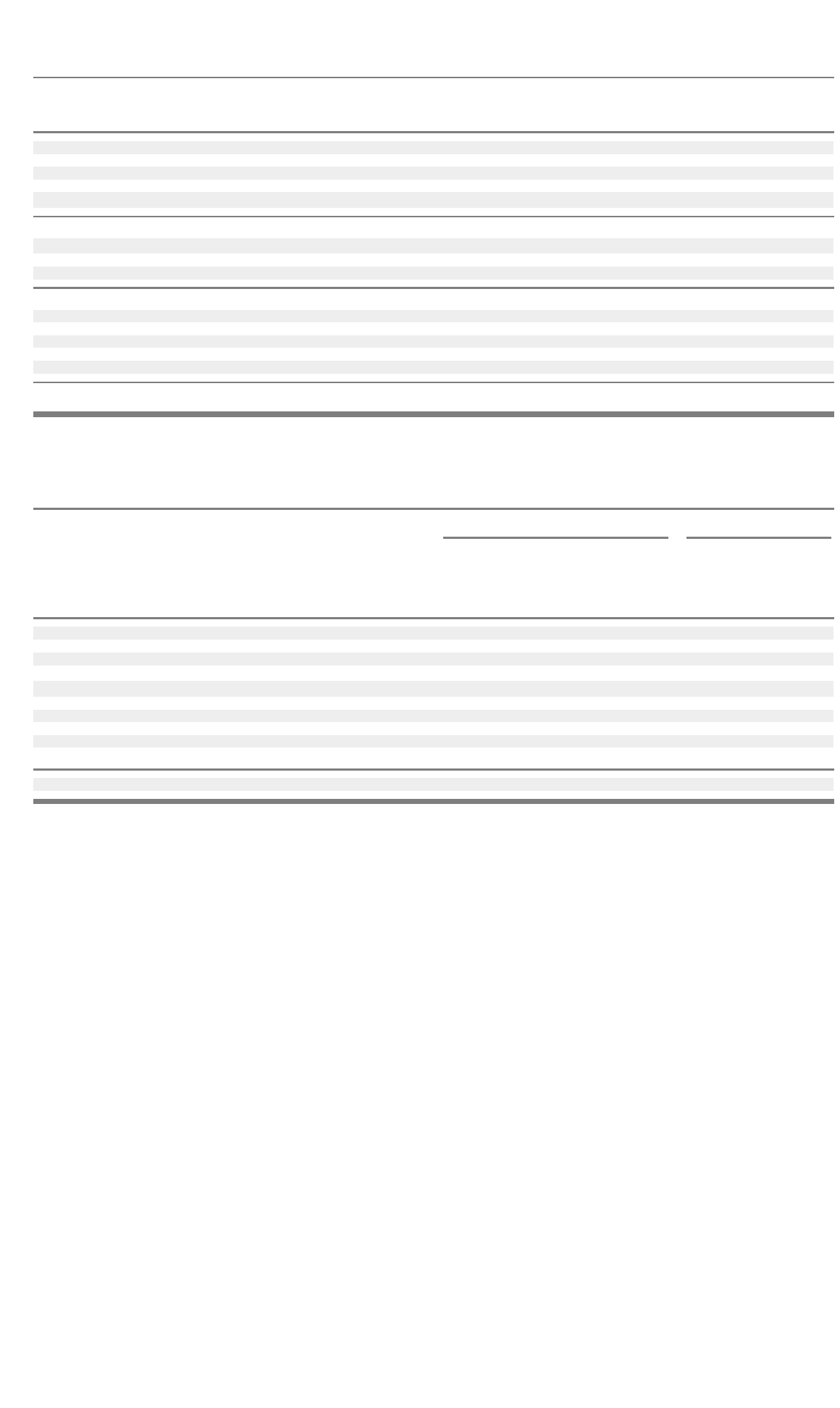

The following is a summary of the total number of outstanding stock options issued to employees of Nortel Networks S.A.:

Outstanding Weighted

options average exercise

(thousands)

p

rice (U.S.$)

Balance at December 31, 2000 6,976 $ 38.10

Granted o

p

tions under all stock o

p

tion

p

lans 1,320 $ 30.36

Options exercised (157) $ 8.91

Options cancelled (1,086) $ 47.84

Options cancelled under stock option exchange program

(a)

(3,604) $ 51.43

Balance at December 31, 2001 3,449 $ 19.47

Granted options under all stock option plans

(a)

5,556 $ 6.39

Options exercised –$ –

Options cancelled (1,312) $ 13.56

Balance at December 31, 2002 7,693 $ 11.03

Eligible employees transferred out of Nortel Networks S.A. (681) $ 9.77

Eli

g

ible em

p

lo

y

ees transferred in Nortel Networks S.A. 227 $ 10.21

Granted options under all stock option plans 4,247 $ 2.37

Options exercised (4) $ 2.89

Options cancelled (843) $ 11.40

Balance at December 31, 2003 10,639 $ 7.70

(a) Approximately 3,604 stock options were tendered for exchange and cancelled. On January 29, 2002, Nortel Networks granted approximately 2,264 newstock

options in connection with the Exchange Program with exercise prices in the range of U.S.$7.16 to U.S.$7.39 per common share.

The following table summarizes information about stock options outstanding as of December 31, 2003:

Options outstanding Options exercisable

Weighted

average Weighted Weighted

Number Remainin

g

avera

g

e Number avera

g

e

outstanding contractual exercise exercisable exercise

Range of exercise prices (thousands) life (in years) price (U.S.$) (thousands) price (U.S.$)

U.S.$1.0600 — U.S.$2.3900 4,001 9.1 $ 2.34 38 $ 1.96

U.S.$2.3901 — U.S.$3.5852 304 9.1 $ 2.58 4 $ 3.34

U.S.$3.5853 — U.S.$5.3779 96 1.9 $ 4.50 85 $ 4.52

U.S.$5.3780 — U.S.$8.0670

(a)

4,006 7.4 $ 6.44 2,182 $ 6.77

U.S.$8.0671 — U.S.$12.1006

(a)

933 4.6 $ 9.51 870 $ 9.61

U.S.$12.1007 — U.S.$18.1510 130 4.8 $ 15.31 130 $ 15.31

U.S.$18.1511 — U.S.$27.2267 914 5.8 $ 23.21 884 $ 23.35

U.S.$27.2268 — U.S.$40.8402 98 6.6 $ 34.30 74 $ 33.99

U.S.$40.8403 — U.S.$61.2605 68 6.3 $ 50.47 69 $ 50.47

U.S.$61.2606 — U.S.$84.6834 89 6.2 $ 74.41 89 $ 74.41

10,639 7.6 $ 7.70 4,425 $ 13.30

(a) Includes approximately 1,591 stock options granted on January 29, 2002 under the Exchange Program.

Em

p

lo

y

ee stock

p

urchase

p

lans

Nortel Networks has ESPPs (including in France) to facilitate the acquisition of common shares of Nortel Networks Corporation at a

discount and the retention of such common shares by eligible employees. The ESPPs have four offering periods each year, with each

offering period beginning on the first day of each calendar quarter. Eligible