200

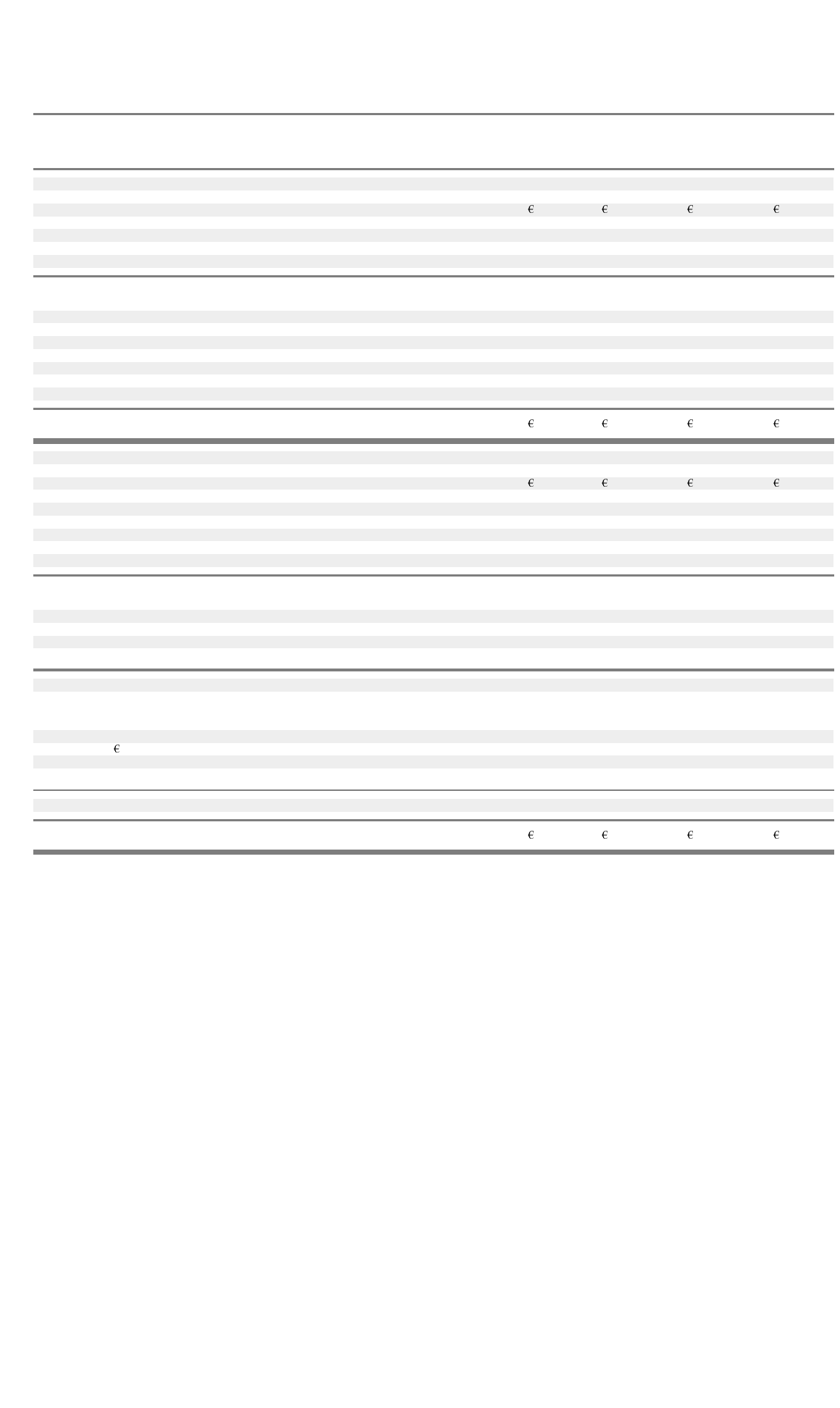

Consolidated Balance Sheets as of December 31, 2002

As Second Pooling o

f

As

previously Restatement interest pooled and

reported Adjustments Adjustments restated

ASSETS

Current assets

Cash and cash equivalents 66,687 897 82,835 150,419

Accounts receivable 45,665 164 38,126 83,955

Inventories — net 58,385 838 20,847 80,070

Receivables from related parties 123,272 115,237 (4,438) 234,071

Other current assets 99,490 (2,972) 9,846 106,364

Total current assets

393,499 114,164 147,216 654,879

Lon

g

-term receivable from related

p

art

y

140,010 – – 140,010

Investments at cost 5,632 – 10,544 16,176

Plant and equipment — net 126,948 82,629 8,544 218,121

Goodwill ––––

Intangible assets — net – – 3,454 3,454

Deferred income taxes — net 35,304 – 7,964 43,268

Other assets 6 – – 6

Total assets

701,399 196,793 177,722 1,075,914

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities

Trade and other accounts payable 80,257 1,406 9,488 91,151

Payables to related parties 52,023 (7,531) 44,834 89,326

Payroll and benefit-related liabilities 44,503 333 5,973 50,809

Contractual Liabilities 33,818 (1,488) 5,488 37,818

Restructuring 15,231 (3,401) 1,516 13,346

Other accrued liabilities 161,005 (4,500) 17,755 174,260

Long-term debt due within one year – 3,073 – 3,073

Total current liabilities

386,837 (12,108) 85,054 459,783

Other liabilities 1,837 268 732 2,837

Long-term deferred Income – – 17,231 17,231

Lon

g

-term deb

t

– 76,457 – 76,457

Long-term note payable to related party 200,000 – 20,000 220,000

Total liabilities

588,674 64,617 123,017 776,308

Minority interest – – 9,757 9,757

SHAREHOLDERS’ EQUITY

Common shares, 0.005 par value 306,544 – – 306,544

Additional paid-in capital – – 43,997 43,997

Accumulated deficit (193,819) 132,176 951 (60,692)

Total shareholders’ equity

112,725 132,176 44,948 289,849

Total liabilities and shareholders’ equity

701,399 196,793 177,722 1,075,914

4

.

A

ccountin

g

chan

g

es

(a) Guarantees

In November 2002, the FASB issued FIN 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others — an interpretation of FASB Statements No. 5, 57 and 107 and rescission of FASB

interpretation No. 34” (“FIN 45”). FIN 45 defines a guarantee as a contract that contingently requires a guarantor to pay a

guaranteed party as a result of changes in an underlying economic characteristic (such as interest rates or market value) that is

related to an asset, a liability or an equity security of the guaranteed party or a third party’s failure to perform under a specified

agreement. FIN 45 requires that a liability be recognized for the estimated fair value of the guarantee at its inception. Guarantees

issued prior to January 1, 2003 are not subject to the recognition and measurement provisions, but are subject to expanded

disclosure requirements. Nortel Networks S.A. has entered into agreements that contain features which meet the definition of a

guarantee under FIN 45. Effective December 31, 2002, Nortel Networks S.A. adopted the disclosure requirements of FIN 45. In

addition, effective January 1, 2003, Nortel Networks S.A. adopted the initial recognition and measurement provisions of FIN 45

which apply on a prospective basis to certain guarantees