F-70

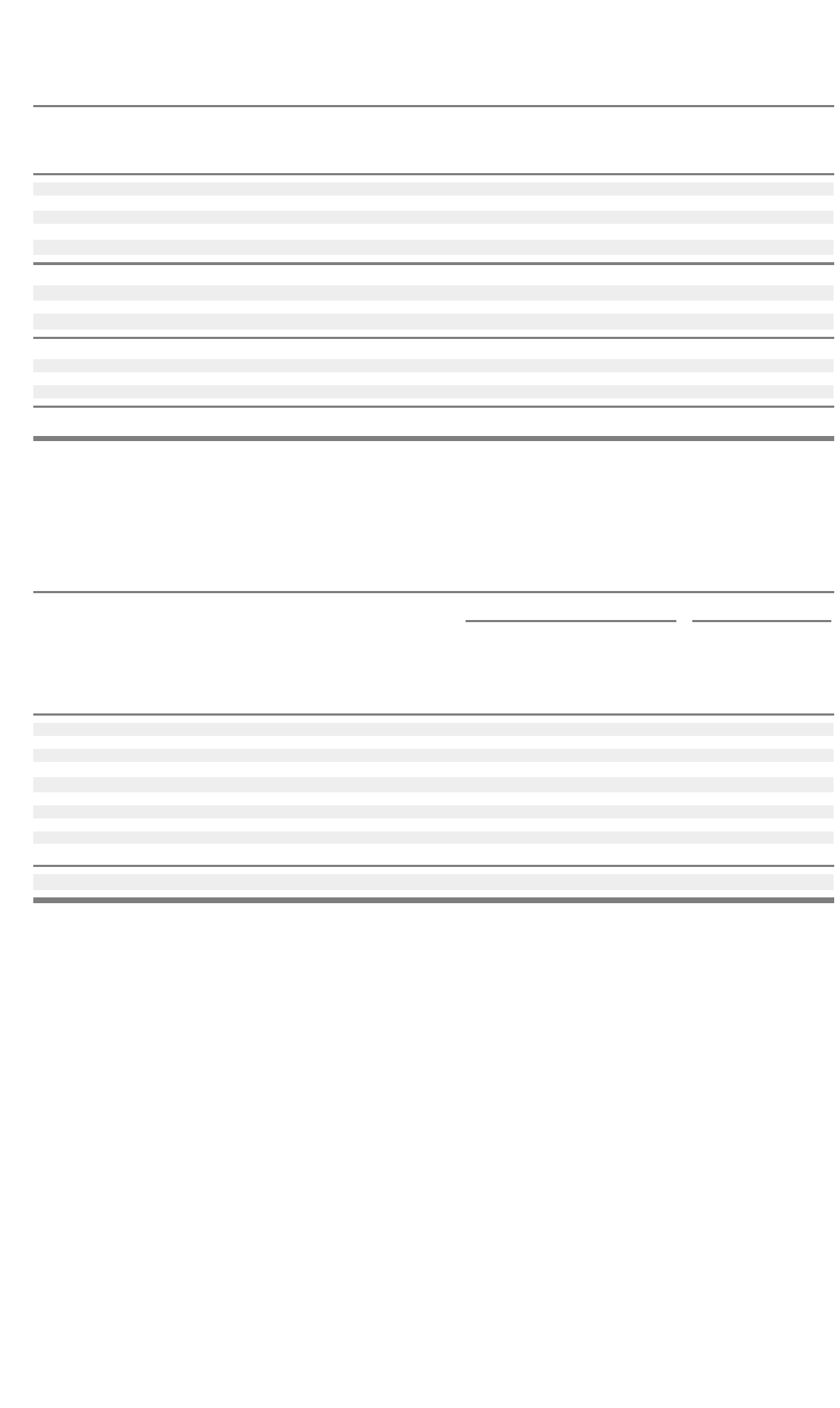

The following is a summary of the total number of outstanding stock options and the maximum number of stock options available for

grant:

Weighted-

Outstanding average Available

options exercise for grant

(thousands)

p

rice (thousands)

Balance at December 31, 2000 325,380 $ 32.06 114,223

Granted options under all stock option plans

(a)

55,565 $ 29.45 (55,565)

Options exercised (20,836) $ 6.53 –

Options cancelled

(b)

(56,793) $ 35.60 41,372

Options cancelled under the stock option exchange program

(c)

(93,416) $ 51.64 93,416

Balance at December 31, 2001 209,900 $ 23.86 193,446

Granted options under all stock option plans

(c)

120,335 $ 7.08 (120,316)

Options exercised (3,269) $ 1.81 –

Options cancelled

(b)

(70,093) $ 26.48 55,036

Balance at December 31, 2002 256,873 $ 15.52 128,166

Granted options under all stock option plans 74,924 $ 2.40 (74,924)

Options exercised (1,550) $ 1.99 –

Options cancelled (41,849) $ 17.94 34,755

Balance at December 31, 2003 288,398 $ 12.27 87,997

(a) Included options granted in relation to various acquisitions during the year ended December 31, 2001 of approximately 1,313.

(b) Included ad

j

ustments to assumed stock o

p

tion

p

lans.

(c) Approximately 93,416 stock options were tendered for exchange and cancelled. On January 29, 2002, Nortel Networks granted approximately 52,700 new stock

options in connection with the Exchange Program with exercise prices in the range of U.S. $7.16 to U.S. $7.78 or Canadian $11.39 per common share.

The following table summarizes information about stock options outstanding as of December 31, 2003:

Options outstanding Options exercisable

Weighted-

average

remaining Weighted- Weighted-

Number contractual average Number average

outstanding life exercise exercisable exercise

Range of exercise prices (thousands) (in years) price (thousands) price

$0.0084 - $2.3900 58,476 9.1 $ 2.32 1,148 $ 1.49

$2.3901 - $3.5852 19,088 8.9 $ 2.57 1,042 $ 2.71

$3.5853 - $5.3779 11,970 5.9 $ 4.80 6,671 $ 4.60

$5.3780 - $8.0670 82,156

(a)

6.5 $ 6.50 49,888 $ 6.67

$8.0671 - $12.1006 43,880

(a)

3.8 $ 9.50 41,186 $ 9.57

$12.1007 - $18.1510 18,220 3.7 $ 15.23 16,580 $ 15.18

$18.1511 - $27.2267 25,602 5.0 $ 23.20 25,026 $ 23.28

$27.2268 - $40.8402 9,185 5.3 $ 34.74 8,058 $ 34.25

$40.8403 - $61.2605 13,455 4.5 $ 51.60 12,987 $ 51.88

$61.2606 - $91.8900 6,366 4.7 $ 72.50 6,337 $ 72.49

288,398 6.30 $ 12.27 168,923

(b)

$ 17.79

(a) Included approximately 41,069 stock options granted under the Exchange Program.

(b) Total number of exercisable options for the years ended December 31, 2002 and 2001 were 156,632 and 132,969, respectively.

Restricted stock unit

p

lan

The Nortel Networks Limited Restricted Stock Unit Plan is a long-term incentive plan that generally provides executive officers and

certain senior management with the opportunity to receive RSUs over a specified period of time if assigned performance thresholds are

achieved and the joint leadership resources committee of the Boards of the Directors of Nortel Networks and NNL (the “Committee”)

determines, in its discretion, to issue and settle all or a portion of the allocated RSUs. Each RSU issued entitles the holder to receive one

common share of Nortel Networks Corporation