F-46

Although the outcome of the APA applications are uncertain, Nortel Networks does not believe the ultimate resolution of these

negotiations will have a material adverse effect on its consolidated financial position, results of operations or cash flows. However, if this

matter is resolved unfavorably, it could have a material adverse effect on Nortel Networks consolidated financial position, results of

operations or cash flows.

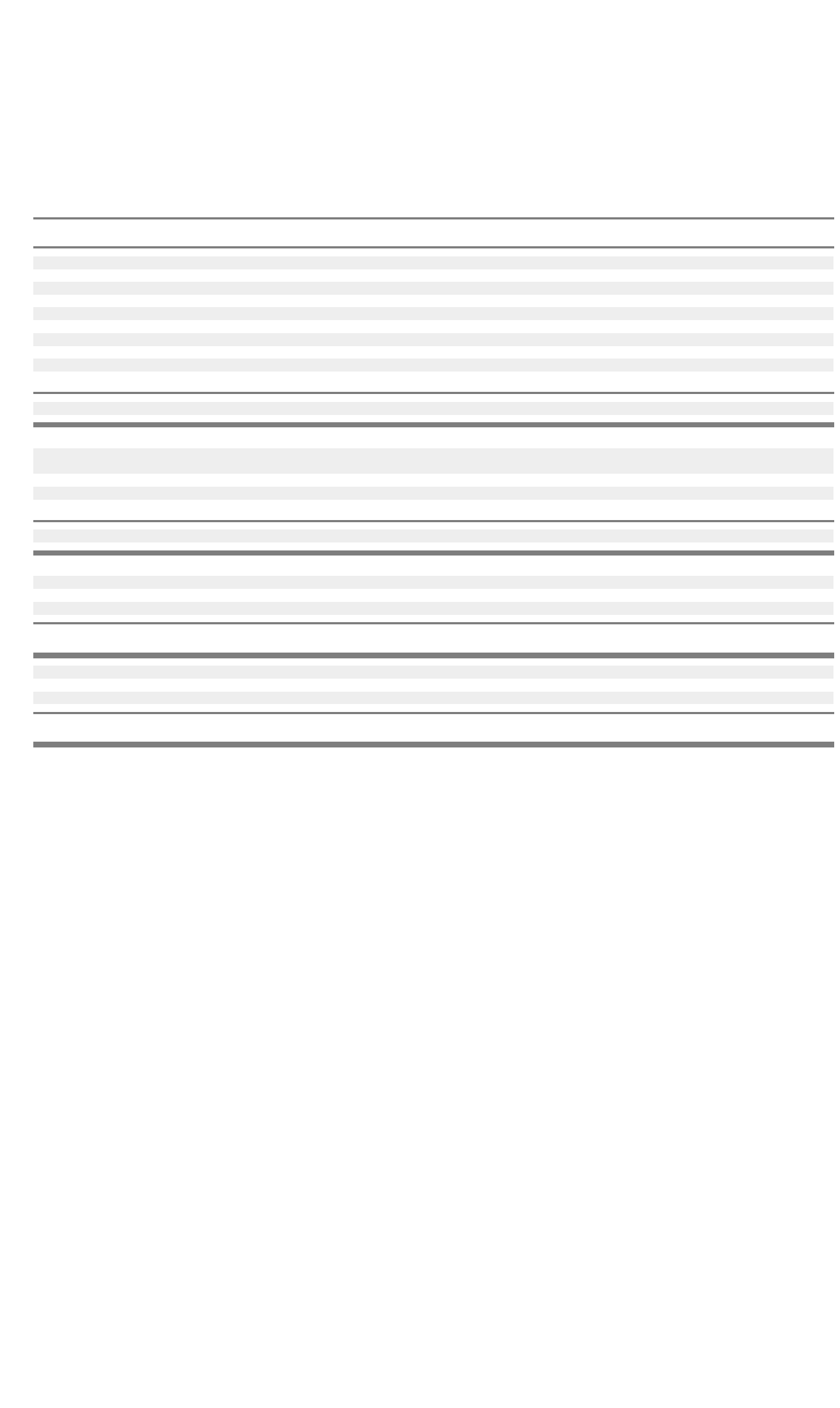

The following is a reconciliation of income taxes, calculated at the Canadian combined federal and provincial income tax rate, to the

income tax benefit (expense) included in the consolidated statements of operations for each of the years ended December 31:

2003 2002 2001

Income taxes at Canadian rates

(2003

—

35.8%, 2002

—

39.4%, 2001

—

40.8%) $ (101) $ 1,320 $ 10,541

Reduction of Canadian taxes applicable to manufacturing profits – (54) (64)

Difference between Canadian rates and rates applicable to subsidiaries in the U.S. and other jurisdictions (23) (33) (524)

Difference between basic Canadian rates and rates applicable to gain (loss) on sale of businesses – (4) (128)

Non-deductible amortization of acquired intangibles and IPR&D expense – (219) (6,800)

Foreign operation tax credit – – 902

Valuation allowances on tax benefits (15) (811) (1,348)

Utilization of losses 98 71 24

Other 121 198 148

Income tax benefit (expense) $ 80 $ 468 $ 2,751

Details of Nortel Networks income (loss):

Earnings (loss) from continuing operations before income taxes, minority interests and equity in net loss of associated

companies:

Canadian, excluding gain (loss) on sale of businesses and assets $ (201) $ (1,270) $ (3,457)

U.S. and other, excluding gain (loss) on sale of businesses and assets 478 (2,100) (22,242)

Gain (loss) on sale of businesses and assets 421(138)

$ 281 $ (3,349) $ (25,837)

Income tax benefit (expense):

Canadian, excluding gain (loss) on sale of businesses and assets $ 188 $ 140 $ 329

U.S. and other, excluding gain (loss) on sale of businesses and assets (108) 335 2,510

Gain on sale of businesses and assets – (7) (88)

$ 80 $ 468 $ 2,751

Income tax benefit (expense):

Current $ 30 $ 43 $ 1,238

Deferred 50 425 1,513

Income tax benefit (expense) $ 80 $ 468 $ 2,751