F-65

Expenses related to outsourcing contracts for the years ended December 31, 2003, 2002 and 2001 amounted to $308, $364 and $498,

respectively, and were for services provided to Nortel Networks primarily related to a portion of information services, payroll, capital

services, accounts payable and training and human resource functions. The amount payable under Nortel Networks outsourcing contracts

is variable to the extent that Nortel Networks workforce fluctuates from the baseline levels contained in the contracts. The table above

shows the minimum commitment contained in the outsourcing contracts.

15.

R

estricted cash and cash e

q

uivalents

As of December 31, 2003 and 2002, approximately $63 and $249, respectively, of cash and cash equivalents was restricted as collateral

for certain bid, performance related and other bonds as well as for certain normal course of business transactions. The cash and cash

equivalents collateral was in addition to the payment of fees and was required as a result of the general economic and industry

environment and NNL’s credit ratings.

16. Ca

p

ital stock

Common shares

Nortel Networks Corporation is authorized to issue an unlimited number of common shares without nominal or par value. The

outstanding number of common shares and prepaid forward purchase contracts included in shareholders’ equity consisted of the

following as of December 31:

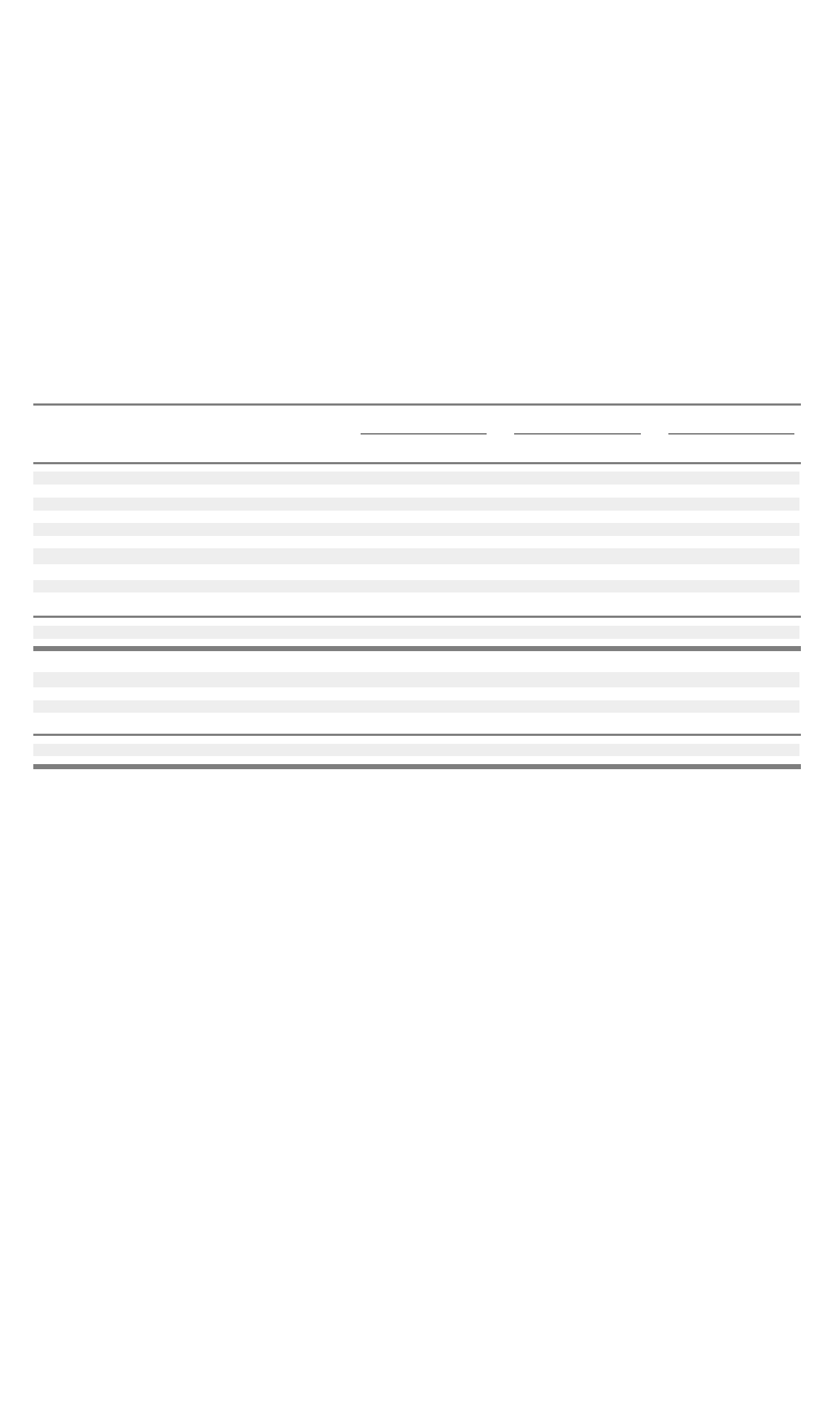

2003 2002 2001

Number $ Number $ Number $

(Number of common shares in thousands)

Common shares:

Balance at beginning of the year 3,844,172 $ 33,234 3,208,285 $ 32,245 3,102,019 $ 29,141

Shares issued pursuant to:

Shareholder dividend reinvestment and stock purchase plan 484 6

Stock o

p

tion

p

lans 1,550 38 3,269 142 20,836 528

Acquisition and acquisition related

(a)

(330) (11) (330) (12) 75,911 2,509

Common share offering

(b)

– – 632,500 858 – –

Conversion of subsidiary preferred shares – – – – 9,035 61

Pre

p

aid forward

p

urchase contracts

(c)

321,322 413 448 1

–

–

Balance at end of the year 4,166,714 $ 33,674 3,844,172 $ 33,234 3,208,285 $ 32,245

(Number of prepaid forward purchase contracts)

Prepaid forward purchase contracts:

(c)

Balance at beginning of the year 28,722 $ 622 – $ – – $ –

Pre

p

aid forward

p

urchase contract offerin

g

–

– 28,750 623

–

–

Prepaid forward purchase contracts settled (19,029) (413) (28) (1) – –

Balance at end of the

y

ear 9,693 $ 209 28,722 $ 622

–

$ –

(a) Common shares issued as part of the purchase price consideration. During the years ended December 31, 2003 and 2002, common shares were cancelled asearnout

provisions were forfeited pursuant to their applicable agreements.

(b) On June 12, 2002, Nortel Networks issued 632,500 common shares for net proceeds of approximately $858, net of issue costs of $36.

(c) Concurrent with the common share offering on June 12, 2002, Nortel Networks issued 28,750 prepaid forward purchase contracts for net proceeds of $623, net of

issue costs of $26, which were recorded as an element of additional paid-in capital. During the years ended December 31, 2003 and 2002, respectively, 321,322 and

448 common shares were issued as a result of the early settlement of 19,029 and 28 prepaid forward purchase contracts. The net proceeds from the settled contracts

of $413 and $1, respectively, were transferred from additional paid-in capital to common shares.

During the year ended December 31, 2001, Nortel Networks Corporation issued common shares to the holders of the 200 Cumulative

Redeemable Class A Preferred Shares Series 4 (“Series 4 Preferred Shares”) of NNL, each of whom had exercised their right to exchange

their Series 4 Preferred Shares for common shares of Nortel Networks Corporation. The number of common shares issued for each

Series4PreferredSharewasdeterminedbydividingCanadian$0.50bythe