F-51

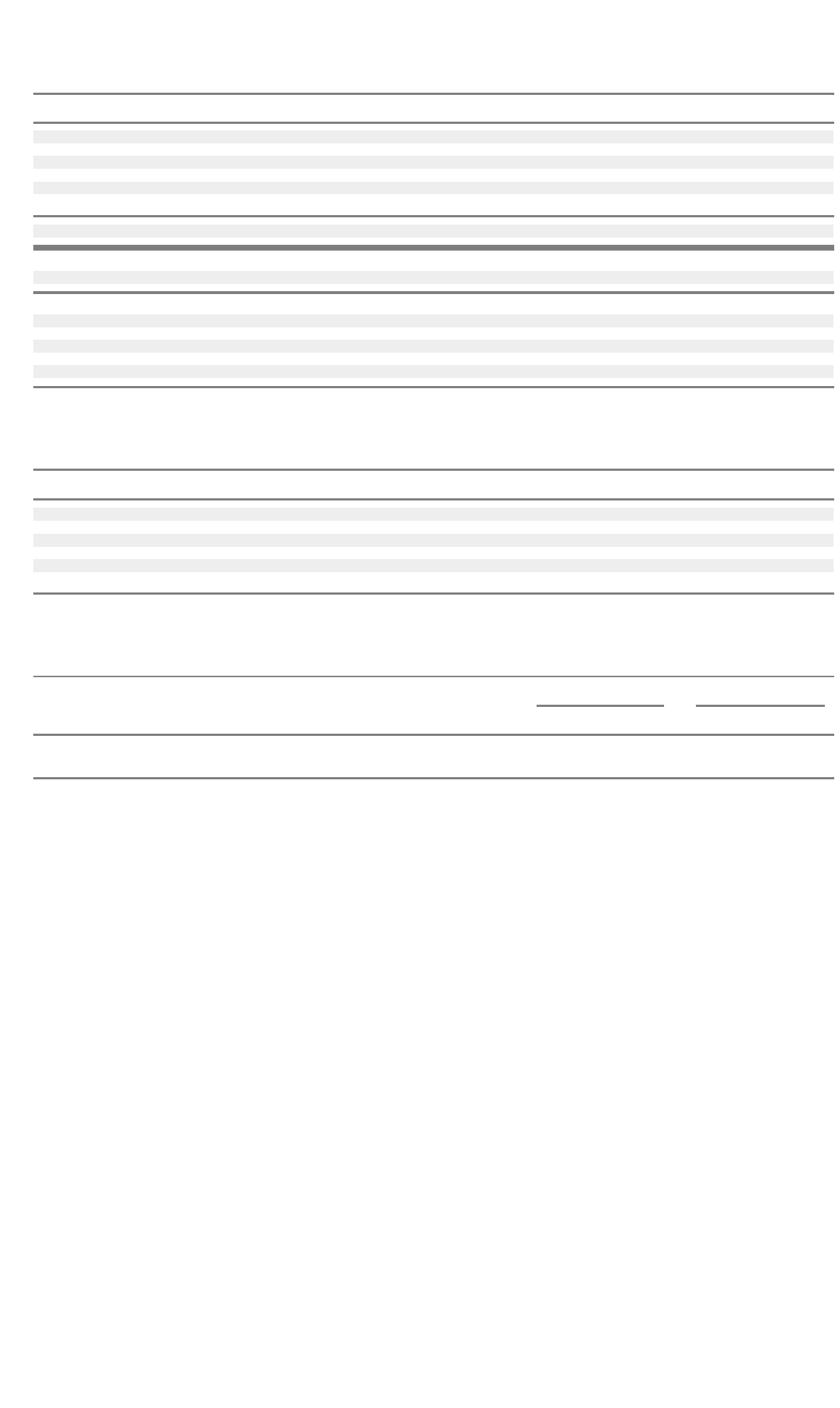

The following details the net cost components, all related to continuing operations, and underlying assumptions of post-retirement

benefits other than pensions for the years ended December 31:

2003 2002 2001

Post-retirement benefit cost:

Service cos

t

$9$10$13

Interest cost 40 37 36

Expected return on plan assets (3) (3) (3)

Amortization (3) (3) (5)

Settlements and curtailments –(9)(21)

Net post-retirement benefit cost $ 43 $ 32 $ 20

Weighted-average assumptions used to determine benefit obligations as at December 31:

Discount rate 6.0% 6.8% 7.0%

Weighted-average assumptions used to determine net post-retirement benefit cost for years ended December 31:

Discount rate 6.8% 7.0% 7.5%

Ex

p

ected rate of return on

p

lan assets 8.0% 8.0% 8.0%

Weighted-average health care cost trend rate 8.5% 8.0% 7.3%

Weighted-average ultimate health care cost trend rate 4.8% 4.7% 5.1%

Year in which ultimate health care cost trend rate will be achieved 2010 2009 2005

Assumed health care cost trend rates have a significant effect on the amounts reported for health care plans. A one percentage-point

change in assumed health care cost trend rates would have the following effects for the years ended December 31:

2003 2002 2001

Effect on aggregate of service and interest costs

1% increase $5$5$5

1% decrease $ (4) $ (4) $ (4)

Effect on accumulated post-retirement benefit obligations

1% increase $ 66 $ 57 $ 56

1% decrease $(55)$(46)$(46)

The target allocation percentages and the year-end percentages based on actual asset balances of the defined benefit plans as of

December 31 are as follows:

2003 2002

Target Actual Target Actual

Debt instruments 39%39%39%44%

Equity securities 61%61%61%56%

The primary investment objective of the defined benefit plans is to invest in a cost effective manner which will provide sufficient funding

for the liabilities of these plans. The defined benefit plans maintain a long-term perspective in regard to investment philosophy and return

expectations which are reflective of the fact that the liabilities of the defined benefit plans mature over an extended period of time. The

investments have risk characteristics consistent with underlying defined benefit plan demographics and liquidity requirements, and are

consistent and compliant with all regulatory standards.

The primary investment performance objective is to obtain competitive rates of return on investments at or above their assigned

benchmarks while minimizing risk and volatility by maintaining an appropriately diversified portfolio. The benchmarks selected are

industry-standard and widely-accepted indices.

The primary method of managing risk within the portfolio is through diversification among and within asset categories, and through the

utilization of a wide array of active and passive investment managers. Broadly, the assets are allocated between debt and equity

instruments. Included within the debt instruments are government and corporate fixed income securities, money market securities,

mortgage-backed securities and inflation indexed securities. Generally, these debt