Pension benefits from the SERP are funded from the general assets of, respectively, Nortel Networks Limited and NNTC in Canada and

Nortel Networks Inc. in the United States.

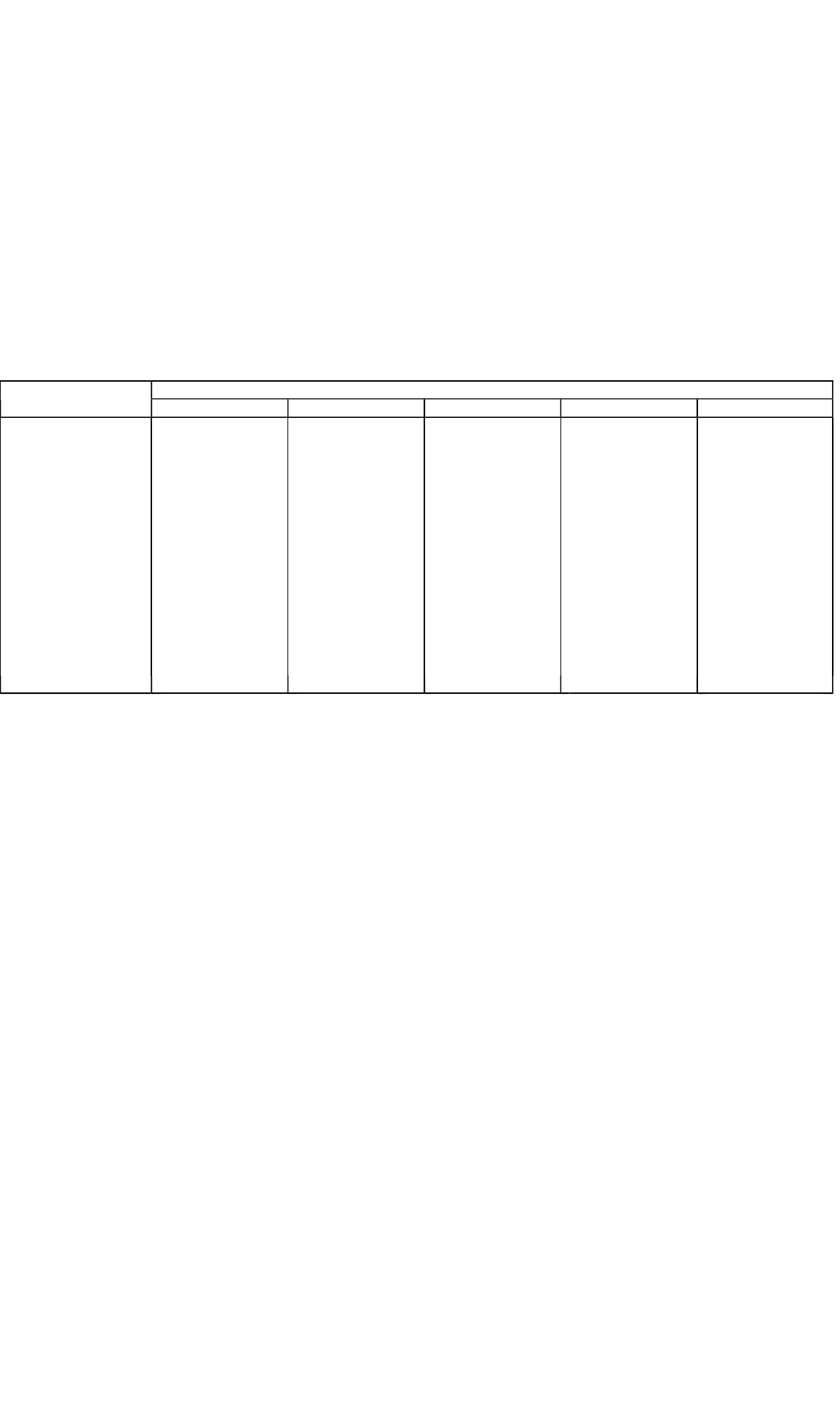

The following tables show the aggregate approximate annual retirement benefits for an eligible executive officer for certain compensation

and years of service categories assuming retirement at age 65, and assuming grandfathering provisions do not apply.

Table I estimates the total retirement benefit (including the SERP) for all participating United States executives (PSP formula members),

and for participating Canadian executives who elected and continue to participate in Part II of the Nortel Networks Limited Managerial and

Non-Negotiated Pension Plan. It estimates the benefit payable as a life annuity with a 60 percent survivor pension.

The approximate benefits for the service of Messrs. Debon, McFadden and DeRoma (named executive officers in 2004) and Mr. Bolouri (a

named executive officer in 2003, along with Messrs. Debon and DeRoma) are shown in Table I. The approximate total eligible earnings and

years of credited pensionable service at December 31, 2004 was: $808,525 and 4.92 years of United States service for Mr. Debon; $708,816

and 27.50 years of Canadian service for Mr. McFadden; and $823,931 and 5.58 years of Canadian pensionable service for Mr. DeRoma.

Mr. DeRoma is also eligible to receive additional credited pensionable service, up to a maximum of 8.125 years, under the terms of his

employment agreement. See “Certain Employment Arrangements”. The approximate total eligible earnings and years of credited pensionable

service for Mr. Bolouri at December 31, 2003 was $696,984 and 22 years of Canadian service.

Table I

Table II estimates the benefits calculated under the United States Cash Balance Plan formula under the Nortel Networks Retirement Income

Plan for participating employees and executives, payable as a straight life annuity.

The approximate benefits for Mr. Owens and Ms. Spradley’s service are shown in Table II. The approximate total eligible earnings and

years of credited service at December 31, 2004 for Mr. Owens was $680,328 and .75 years of United States service and $1,139,325 and

16.67 years of United States service for Ms. Spradley. As Mr. Owens and Ms. Spradley are in the Cash Balance Plan, eligible earnings for

2004 reflect 2004 base salary and for Ms. Spradley it also included the one-time award paid during 2004 under the SUCCESS Plan. Mr. Owens

is also eligible for a Special Pension Arrangement. See “Certain Employment Arrangements”.

157

Years of Service

Total Earnings 15 20 25 30 35

$600,000 $138,578 $169,034 $207,612 $235,023 $273,602

700,000 161,674 197,206 242,215 274,194 319,202

800,000 184,770 225,379 276,817 313,365 364,802

900,000 207,866 253,551 311,419 352,535 410,403

1,000,000 230,963 281,724 346,021 391,706 456,003

1,100,000 254,059 309,896 380,623 430,876 501,603

1,200,000 277,155 338,068 415,225 470,047 547,203

1,300,000 300,251 366,241 449,827 509,217 592,804

1,400,000 323,348 394,413 484,429 548,388 638,404

1,500,000 346,444 422,585 519,031 587,558 684,004

1,600,000 369,540 450,758 553,633 626,729 729,605

1,700,000 392,636 478,930 588,235 665,900 775,205

1,800,000 415,733 507,102 622,837 705,070 820,805

1,900,000 438,829 535,275 657,439 744,241 866,406

2,000,000 461,925 563,447 692,042 783,411 912,006