213

10.

R

elated

p

art

y

transactions

In the ordinary course of business, Nortel Networks S.A. engages in transactions with Nortel Networks and certain of Nortel Networks

affiliates. These transactions are measured at their exchange amounts.

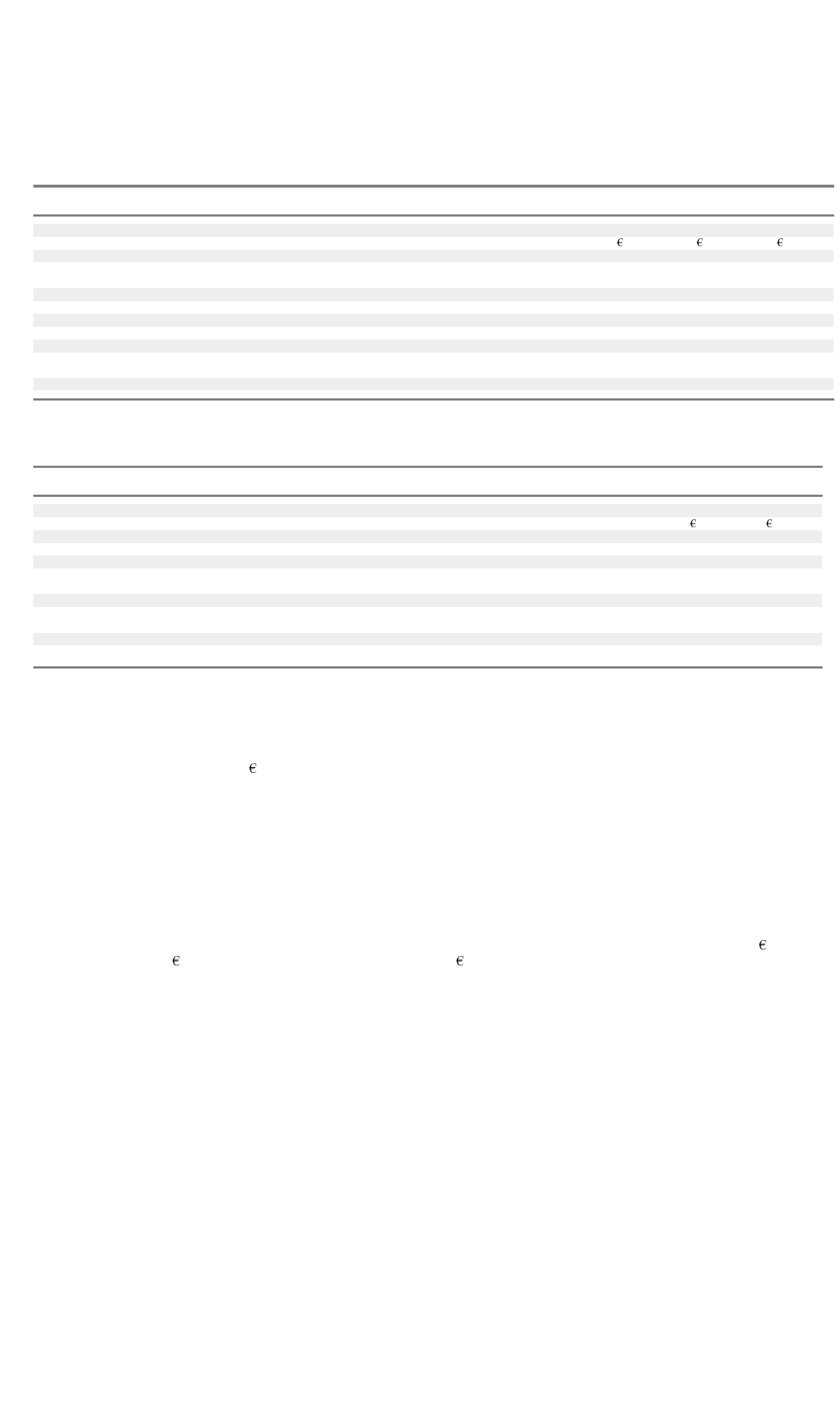

Transactions with related parties for the years ended December 31 are summarized as follows:

2003 2002 2001

Billed to related parties

Revenues 515,478 458,918 439,072

Other income (expense) — net 19,572 43,741 58,389

Billed from related parties

Purchases 127,327 230,763 424,816

Selling, general and administrative expense 19,494 44,085 15,149

Research and development expense 16,536 22,722 18,105

Interest expense 778 4,617 627

Capital acquisitions 88 4,450 23,624

Business transferred to related

p

arties 15,365 33,755 21,905

Issuance of common shares 150,000 485,363 –

The following table shows the balance sheet position in respect of related parties as of December 31:

2003 2002

Receivables from related parties

Due from Nortel Networks Limited 109,388 152,892

Due from affiliates 145,309 81,179

Pa

y

ables to related

p

arties

Due to Nortel Networks Limited 1,991 12,529

Due to affiliates 30,011 76,797

Long-term notes receivable from Nortel Networks Limited – 140,010

Notes payable to related parties

Current 160 –

Long-term 70,000 220,000

H

ead o

ff

ice cost

Nortel Networks S.A. was charged until December 31, 2001 by Nortel Networks for its share of head office costs incurred by Nortel

Networks that are attributable to the activities of Nortel Networks S.A. These charges, which are included in selling, general and

administrative expense, amounted to

4,017 in 2001.

Global

p

ro

f

it s

p

lit

Nortel Networks S.A. participates with Nortel Networks and certain of Nortel Networks S.A. affiliates in various agreements with respect

to intercompany product sale and purchase transactions, including research and development costs. Prior to 2001, the pricing of

intercompany transactions between Nortel Networks S.A. and certain of its affiliates was determined through the application of various

methodologies intended to produce arm’s length results and pricing for Nortel Networks S.A. Nortel Networks S.A. also shared in global

research and development costs based on the benefits derived from the research and development utilized in its geographic market.

Effective January 1, 2001, the global research and development cost sharing methodology was replaced with a global profit split

methodology based upon the historical research and development costs of the participants, and further intended to produce arm’s length

results for Nortel Networks S.A. Under that methodology, Nortel Networks S.A. received a charge in 2001 of approximately

114,271, a

credit of approximately

65,013 for 2002 and a charge of approximately 58,224 for 2003. These were all allocated to the cost of

revenues.

Other

p

ro

f

it sharin

g

a

g

reements

Nortel Networks S.A. has entered into certain agreements with a related party under which the profit or loss that the affiliate is recording

on certain contracts with external customers is split on a defined basis between the affiliate and Nortel Networks S.A. The agreements are

aimed to produce arm’s length results and pricing for Nortel Networks S.A. and remunerate the know-how that Nortel Networks S.A. is

sharing with the affiliate.