F-37

Goodwill:

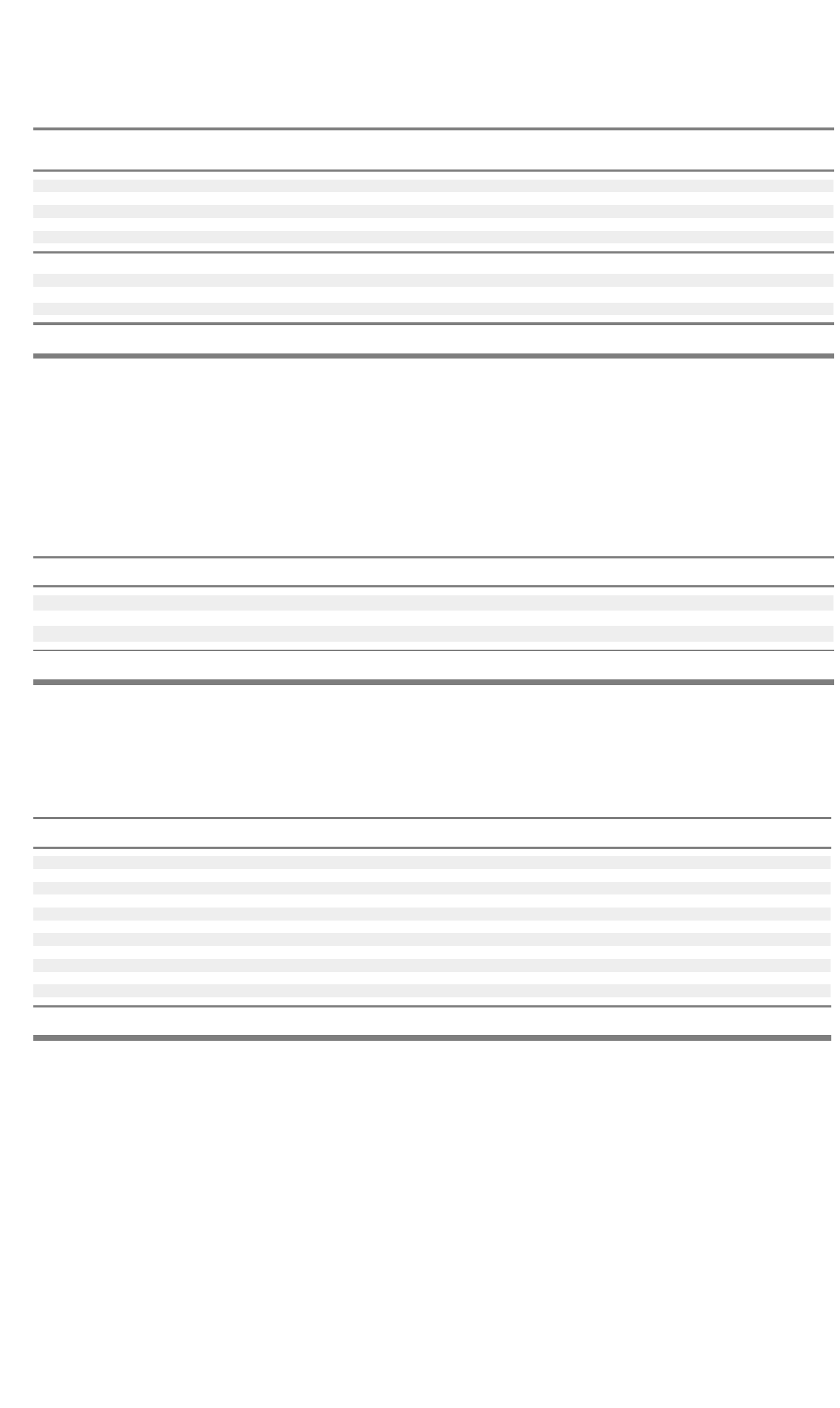

The following table outlines goodwill by reportable segment:

During the year ended December 31, 2003, Nortel Networks performed its annual goodwill impairment test and concluded that there was

no impairment. During the three months ended September 30, 2002, an impairment test was performed on goodwill in accordance with

SFAS 142 for all reporting units due to a significant adverse change in the business climate and taking into consideration Nortel

Networks market capitalization at the end of the third quarter of 2002. All of Nortel Networks reporting units had fair values in excess of

their carrying values with the exception of Optical Networks. As a result of the impairment test, Nortel Networks recorded a write down

of goodwill of $595 within the Optical Networks segment during the year ended December 31, 2002.

I

ntangible assets — net:

Other accrued liabilities:

Wireless Enterprise Wireline Optical

Networks Networks Networks Networks Other Total

Balance — net as of December 31, 2001 $ 21 $ 1,658 $ 524 $ 590 $ 15 $ 2,808

Change:

Disposal – –

–

– (15) (15)

Impairment – –

–

(595) – (595)

Foreign exchange – (2) (2) 5 – 1

Balance — net as of December 31, 2002 21 1,656 522 – – 2,199

Change:

Additions

(a)

13 31 43 9 – 96

Foreign exchange 1 5 4 – – 10

Balance — net as of December 31, 2003 $ 35 $ 1,692 $ 569 $ 9 $ – $ 2,305

(a) See note 10 for additional information.

2003 2002

Acquired technology

(a)

$ – $ 98

Other intangible assets

(b)

45 –

Pension intangible assets

(c)

41 41

Intangible assets — net $86 $139

(a) As of December 31, 2003, acquired technology was fully amortized.

(b) Other intangible assets are being amortized over a ten year period ending in 2013. Amortization expense for the next five years commencing in 2004 is expected to

be $9, $6, $5, $5 and $4, respectively. The amortization expense is denominated in a foreign currency and may fluctuate due to changes in foreign exchange rates.

(c) Pension intangible assets were recorded as required by SFAS No. 87, “Employers’ Accounting for Pensions”. Amounts are not amortized but are adjusted as part of

the annual minimum pension liability assessment.

2003 2002

Outsourcing and selling, general and administrative related $ 302 $ 486

Customer deposits 73 69

Product related 120 171

Warrant

y

387 408

Deferred income 761 1,108

Miscellaneous taxes 76 74

Income taxes payable 111 150

Current liabilities of discontinued operations 663

Interest payable 62 67

Advance billings in excess of revenues recognized to date on long-term contracts 509 394

Other 98 267

Other accrued liabilities $ 2,505 $ 3,257