211

8.

I

ncome taxes

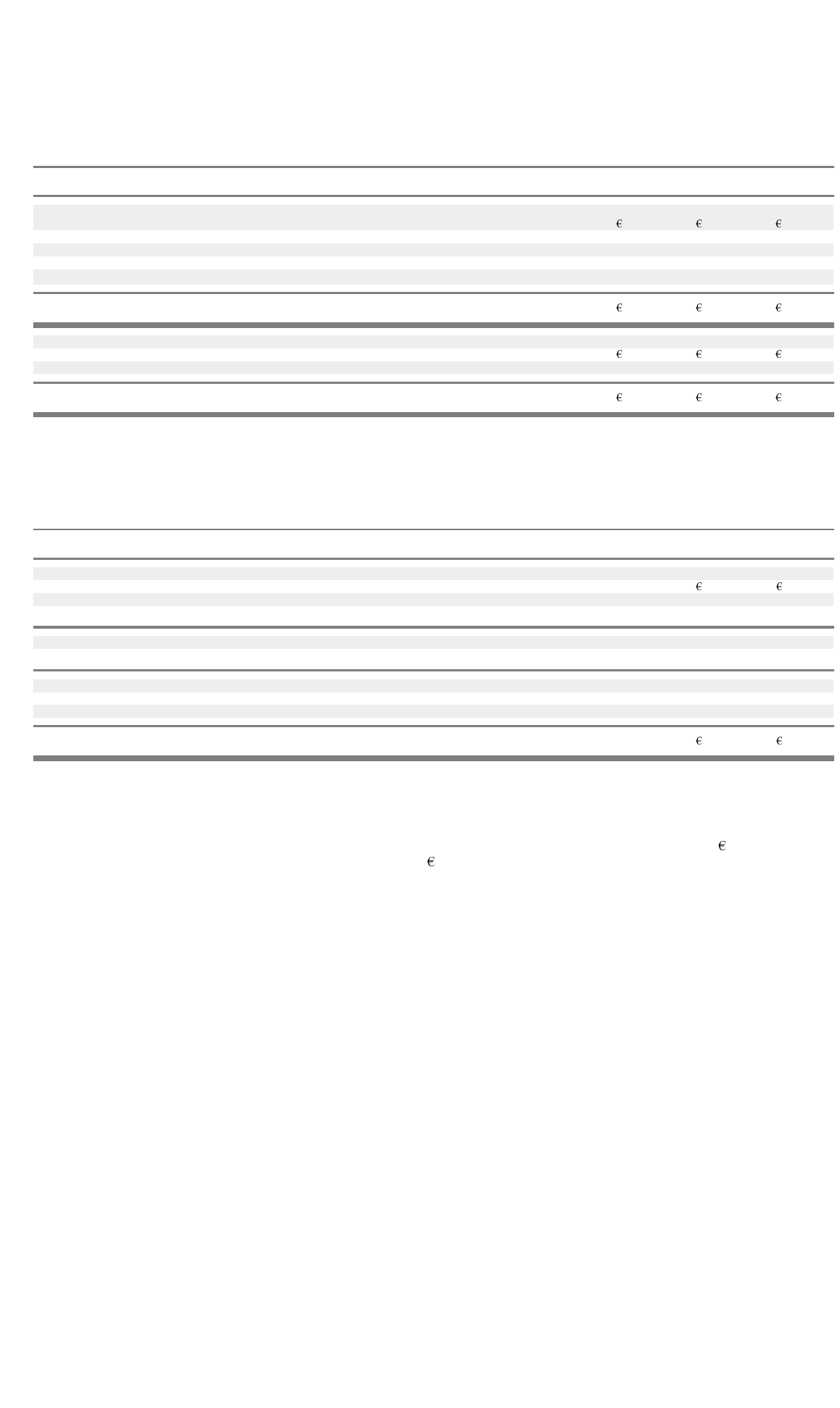

The following is a reconciliation of income taxes, calculated at the French income tax rate, to the income tax benefit (expense) included

in the consolidated statements of operations for the years ended December 31:

2003 2002 2001

Income taxes at French rates

(2003 - 35.4% 2002 - 35.4% 2001 - 36.4%)

50,886 74,647 139,325

Research and development credit 6,104 6,098 14,058

Foreign tax (485) (2,119) (2,950)

Change in valuation allowance (16,347) (77,259) (138,796)

Other

(a)

(34,544) 273 22,436

Income tax benefit/(provision) 5,614 1,640 34,073

Income tax benefit/(provision)

Current (490) (2,270) 5,068

Deferred 6,104 3,910 29,005

Income tax benefit/(provision) 5,614 1,640 34,073

(a) Other includes rate differential as well as

p

ermanent differences.

The following table shows the significant components included in deferred income taxes as of December 31:

2003 2002

Assets:

Tax benefit of tax credits 24,398 20,065

Tax benefit of losses 302,380 333,946

Provisions and reserves 12,710 (40,719)

339,488 313,292

Valuation allowance (263,894) (247,547)

75,594 65,745

Liabilities:

Plant and equipment 28,084 22,477

Net deferred income tax assets 47,510 43,268

The deferred income tax assets are all receivable in cash from the French government within the next 3 years as of December 31, 2003 or

can be offset against taxes currently payable in that same period.

As of December 31, 2003, Nortel Networks S.A. had consolidated net operating loss carry forwards of approximately

747,359 which

will carry forward indefinitely and net capital loss carryforwards of

73,997 which expire in 2006 to 2013.

Nortel Networks S.A. and certain subsidiaries are currently subject to an examination by taxation authorities in France and have received

a preliminary notice of proposed assessment for a material amount. No amount has been included in the provision for income taxes for

this notice of proposed assessment as Nortel Networks S.A. believes that this proposed assessment is without merit. However, if this

matter is ultimately resolved unfavourably, it could have a material adverse effect on the consolidated financial position, results of

operations, cash flows or tax carryforward attributes of Nortel Networks S.A.