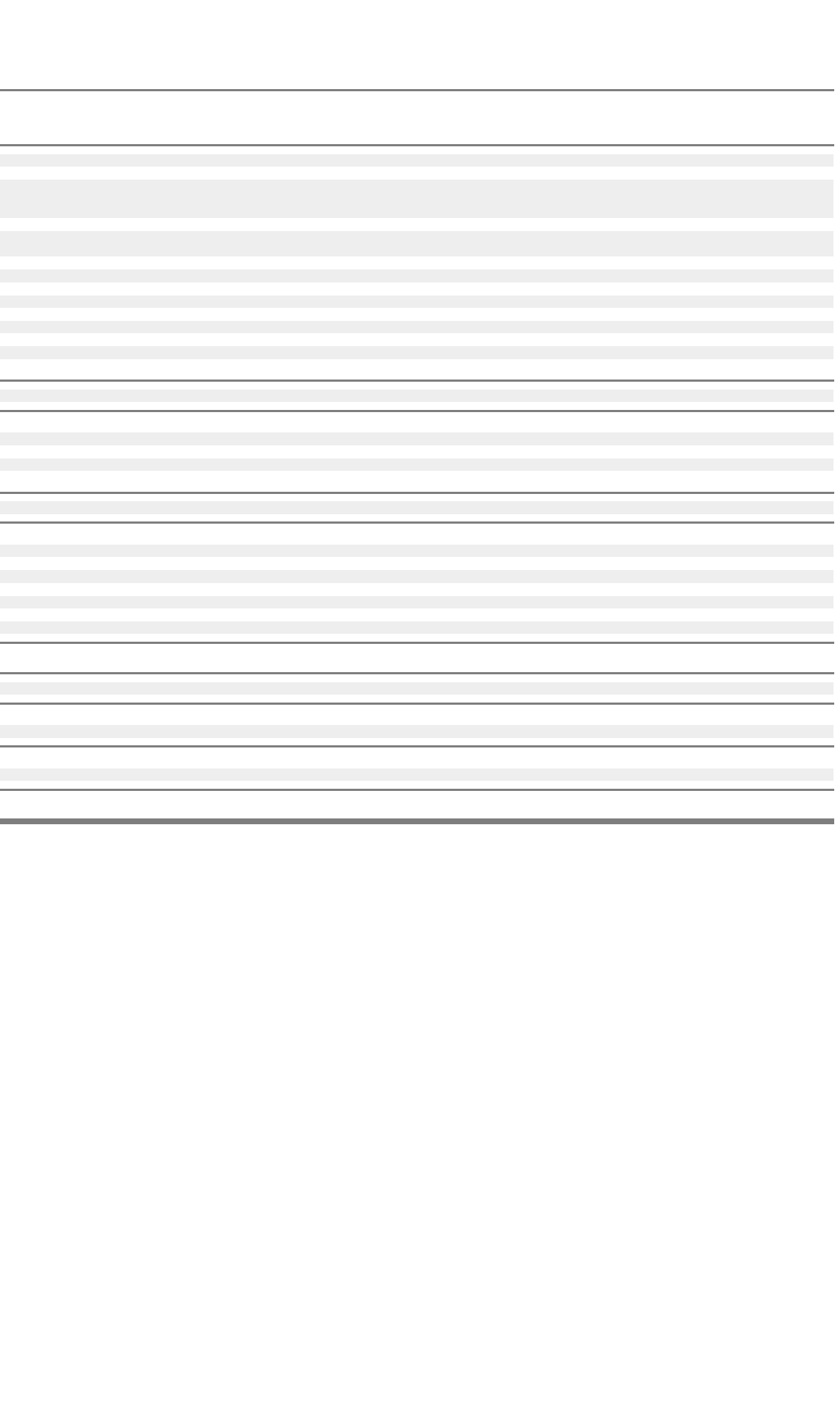

Supplemental Consolidating Statements of Cash Flows for the year ended December 31, 2003:

F-90

Nortel Nortel Non-

Networks Networks Guarantor Guarantor

(millions of U.S. dollars) Corporation Limited Subsidiaries Subsidiaries Eliminations Total

Cash flows from (used in) o

p

eratin

g

activities

Net earnings (loss) from continuing operations $ 250 $ 422 $ 594 $ 135 $ (1,139) $ 262

Adjustments to reconcile net earnings (loss) from continuing

operations to net cash from (used in) operating activities, net of

effects from acquisitions and divestitures of businesses:

Amortization and depreciation – 75 249 217 – 541

Non-cash portion of special charges and related asset write

downs

– 9 76 2 – 87

Equity in net loss of associated companies (304) (351) (404) (9) 1,104 36

Current and deferred stock option compensation 15 4 19 4 – 42

Deferred income taxes 14 5 (82) 13 – (50)

Other liabilities

–

83 74 4 – 161

(Gain) loss on repurchases of outstanding debt securities – (4) –

–

–(4)

(Gain) loss on sale or write-down of investments and businesses – (7) (4) (40) – (51)

Other — net 766 291 (904) (974) 35 (786)

Change in operating assets and liabilities 2 190 (741) 396 – (153)

Intercompany/related party activity (836) (831) 1,506 161 – –

Net cash from (used in) operating activities of continuing operations (93) (114) 383 (91) – 85

Cash flows from (used in) investing activities

Expenditures for plant and equipment – (41) (85) (46) – (172)

Proceeds on disposals of plant and equipment – 7 28 3 – 38

Acquisitions of investments and businesses — net of cash acquired – (60) (6) 8 – (58)

Proceeds on sale of investments and businesses – 6 101

–

–107

Net cash from (used in) investing activities of continuing operations – (88) 38 (35) – (85)

Cash flows from (used in) financing activities

Dividends on preferred shares – (35) –

–

35 –

Dividends paid by subsidiaries to minority interests – – –

–

(35) (35)

Increase (decrease) in notes payable — net – – 4 (49) – (45)

Proceeds from long-term debt – – –

–

––

Repayments of long-term debt – (199) (2) (69) – (270)

Re

p

a

y

ments of ca

p

ital leases

p

a

y

able

–

–(12)

–

–(12)

Issuance of common shares 3 – –

–

– 3

Net cash from (used in) financin

g

activities of continuin

g

o

p

erations 3 (234) (10) (118) – (359)

Effect of foreign exchange rate changes on cash and cash equivalents 3 2 137 34 – 176

Net cash from (used in) continuing operations (87) (434) 548 (210) – (183)

Net cash from (used in) discontinued operations 120 175 224 (129) – 390

Net increase (decrease) in cash and cash equivalents 33 (259) 772 (339) – 207

Cash and cash e

q

uivalents at be

g

innin

g

of

y

ear 35 251 2,392 1,112 – 3,790

Cash and cash equivalents at end of year $ 68 $ (8) $ 3,164 $ 773 $ – $ 3,997