192

to the settlement date are recorded in net earnings (loss) in the period incurred. The payment amount is established for Stock

Appreciation Rights (“SARs”) on the date of exercise of the award by the employee, for Restricted Stock Units (“RSUs”) on the

vesting date of the award. Stock-based awards which are substantively discretionary in nature are recorded in the period that the

issuance and settlement of the award is approved.

Under various stock option programs of Nortel Networks Corporation (“NNC”), the ultimate parent company of Nortel Networks

S.A., options may be granted to various eligible employees and directors of Nortel Networks S.A. to purchase common shares of

Nortel Networks Corporation.

NNC has stock purchase plans for eligible employees in eligible countries (including France), to facilitate the acquisition of the

common shares of Nortel Networks Corporation at a discount (“ESPPs”). Nortel Networks S.A. contribution to the ESPPs is

recorded as compensation expense on a quarterly basis as the obligation to contribute is incurred.

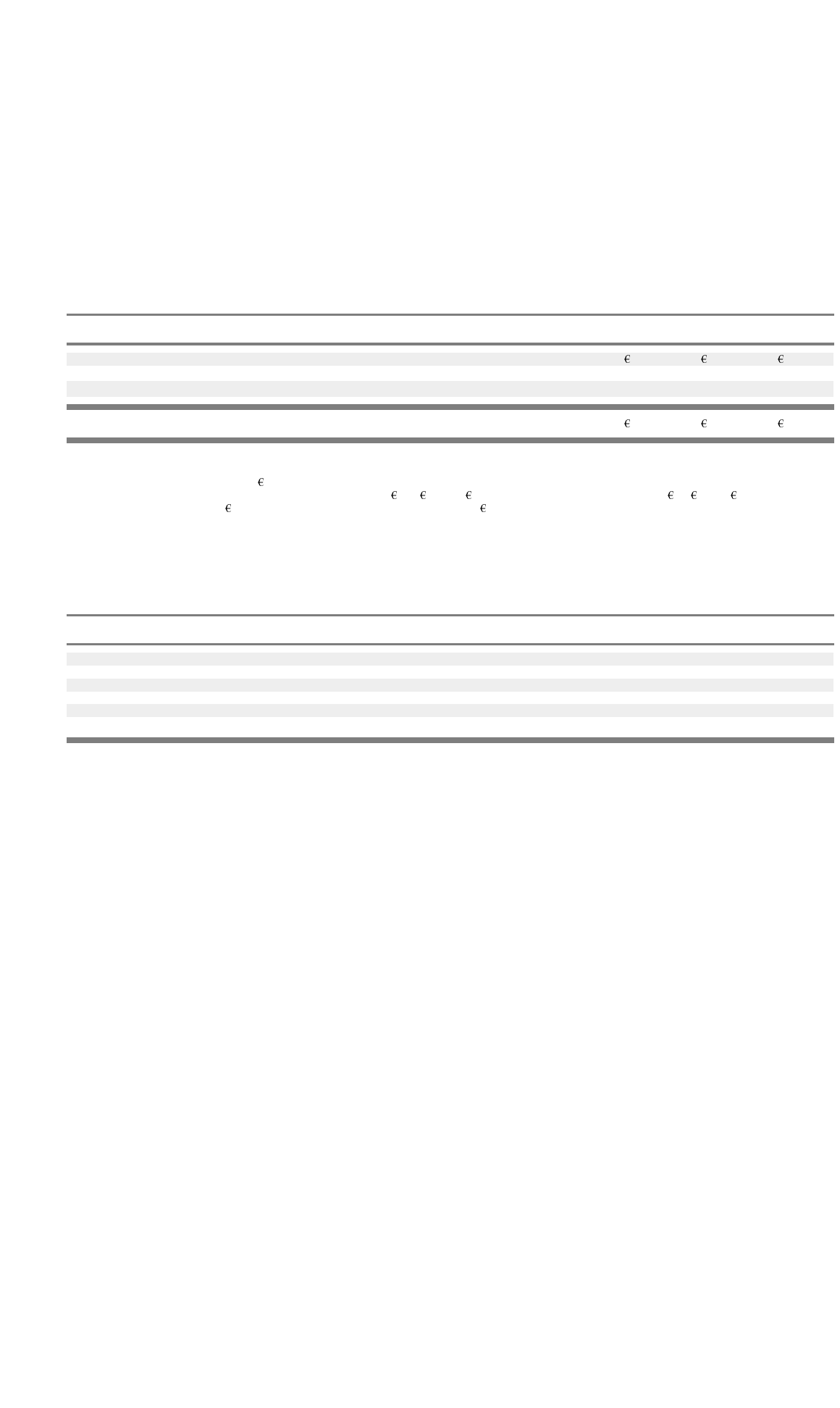

Had Nortel Networks S.A. applied the fair value based method to all stock-based awards in all periods, reported net earnings

(loss) would have been adjusted to the pro forma amounts indicated below for the following years ended December 31:

2003 2002 2001

Net earnings (loss) — reported (138,889) (206,174) (339,539)

Stock-based compensation — reported

(a)

2,133 463 917

Stock-based compensation — pro forma

(b)

(10,435) (34,685) (45,134)

Net earnin

g

s (loss) —

p

ro forma (147,191) (240,396) (383,756)

(a) Stock-based compensation — reported, included, for the years ended December 31, 2003, 2002 and 2001:

i. Stock option expense of

1,333,nilandnil,respectively,whichwasnetoftaxofnilineachperiod;

ii. Employer portion of ESPPs contributions expense of

314, 463 and 917, respectively, which was net of tax of 25, 51 and 72, respectively;

iii. RSUs expense of

486, nil and nil, respectively, which was net of tax of 98, nil and nil respectively.

(b) Stock-based com

p

ensation —

p

ro forma ex

p

ense for the

y

ears ended December 31, 2003, 2002 and 2001, which was net of tax of nil.

The following weighted average assumptions were used in computing the fair value of stock options for purposes of expense

recognition and pro forma disclosures, as applicable, for the following periods:

2003 2002 2001

Black-Scholes weighted-average assumptions

Expected dividend yield 0.00% 0.00% 0.00%

Expected volatility 92.49% 71.33% 70.36%

Risk-free interest rate 2.81% 4.49% 4.49%

Ex

p

ected o

p

tion life in

y

ears 4 4 4

Weighted-average stock option fair value per option granted (U.S.$)

$1.6 $3.5 $8.4

(t)

R

ecent accountin

gp

ronouncements

In March 2004, the EITF reached consensus on Issue No. 03-1, “The Meaning of Other-Than-Temporary Impairment and Its

Application to Certain Investments” (“EITF 03-1”). EITF 03-1 provides guidance on determining when an investment is considered

impaired, whether that impairment is other than temporary and the measurement of an impairment loss. EITF 03-1 is applicable to

marketable debt and equity securities within the scope of SFAS No. 115, “Accounting for Certain Investments in Debt and Equity

Securities” (“SFAS 115”), and SFAS No. 124, “Accounting for Certain Investments Held by Not-for-Profit Organizations”, and

equity securities that are not subject to the scope of SFAS 115 and not accounted for under the equity method of accounting. In

September 2004, the FASB issued FSP EITF 03-1-1, “Effective Date of Paragraphs 10-20 of EITF Issue No. 03-1, “The Meaning

of Other-Than-Temporary Impairment and Its Application to Certain Investments”, which delays the effective date for the

measurement and recognition criteria contained in EITF 03-1 until final application guidance is issued. The delay does not suspend

the requirement to recognize other-than-temporary impairments as required by existing authoritative literature. The adoption of

EITF 03-1 is not expected to have a material impact on Nortel Networks S.A. results of operations and financial position.