F-49

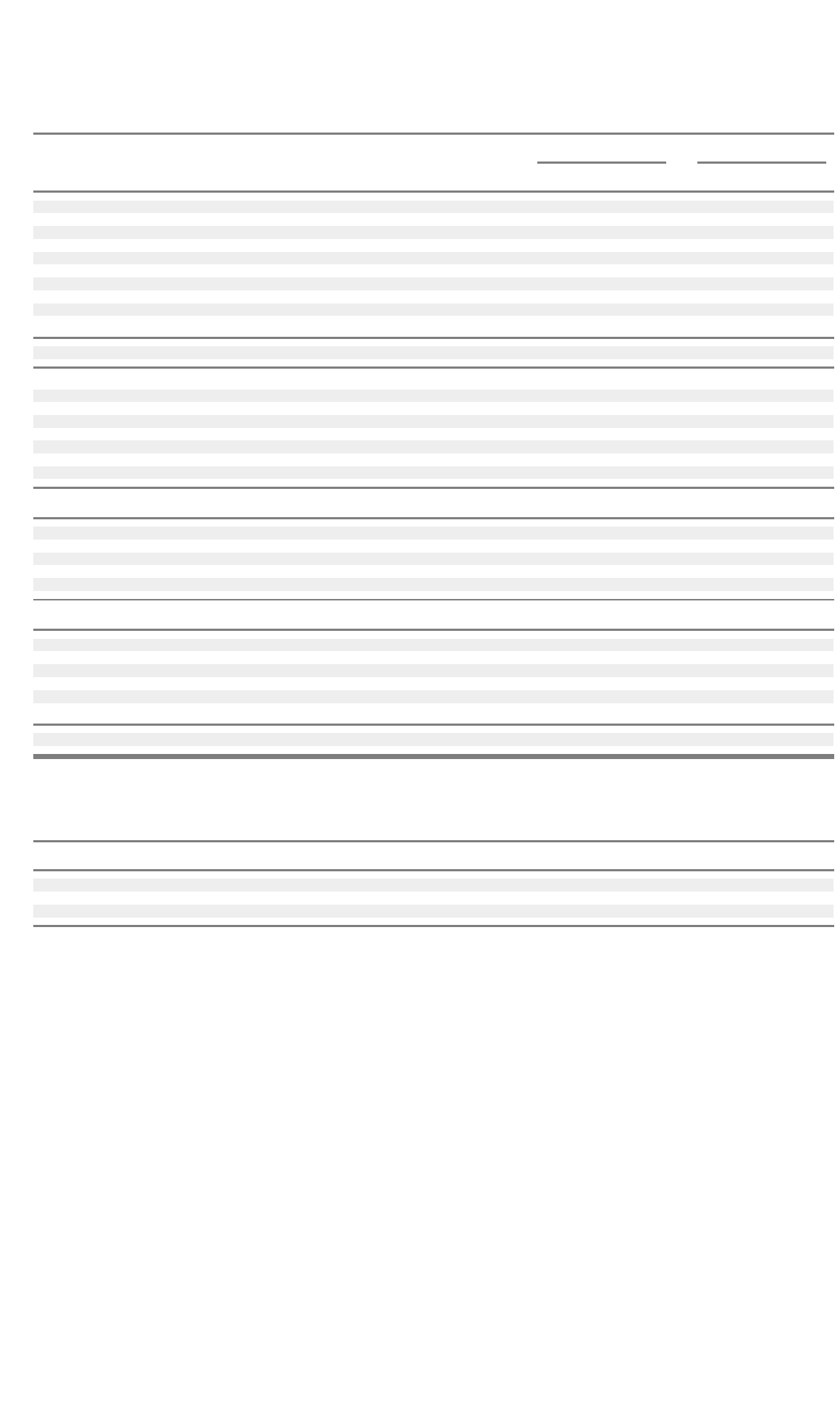

The following details the unfunded status of the defined benefit plans and post-retirement benefits other than pensions, and the associated

amounts recognized in the consolidated balance sheets as of December 31:

The following details selected information for defined benefit plans, all of which have accumulated benefit obligations in excess of the

fair value of plan assets as of December 31:

Defined benefit plans Post-retirement benefits

2003 2002 2003 2002

Chan

g

e in benefit obli

g

ation:

Benefit obligation — beginning $ 6,187 $ 6,053 $ 568 $ 529

Service cost 118 158 9 10

Interest cost 401 402 40 37

Plan participants’ contributions 7 12 3 2

Plan amendments 5–––

Actuarial loss (gain) 362 (19) 106 20

Divestitures/settlements (116) (386) – (3)

Benefits paid (459) (320) (37) (31)

Foreign exchange 850 287 65 4

Benefit obligation — ending $ 7,355 $ 6,187 $ 754 $ 568

Change in plan assets:

Fair value of plan assets — beginning $ 4,386 $ 5,009 $ 41 $ 41

Actual return on plan assets 626 (270) 3 –

Employer contributions 399 153 31 28

Plan

p

artici

p

ants’ contributions 712 3 2

Divestitures/settlements (170) (424) – –

Benefits paid (459) (320) (37) (31)

Foreign exchange 626 226 9 1

Fair value of plan assets — ending $ 5,415 $ 4,386 $ 50 $ 41

Unfunded status of the plans $ (1,940) $ (1,801) $ (704) $ (527)

Unrecognized net plan benefits existing at January 1, 1987 (1) (4) – –

Unrecognized prior service cost (credit) 20 20 (29) (31)

Unrecognized net actuarial losses (gains) 1,664 1,403 119 13

Contributions after measurement date 108 113 3 –

Net amount recognized $(149) $(269) $(611) $(545)

Amount recognized in the accompanying consolidated balance sheets consist of:

Other liabilities — long-term $ (1,290) $ (1,040) $ (581) $ (516)

Other liabilities — current (72) (93) (30) (29)

Intangible assets — net 42 41 – –

Foreign currency translation adjustment 151 22 – –

Accumulated other comprehensive loss 1,020 801 – –

Net amount recognized $ (149) $ (269) $ (611) $ (545)

2003 2002

Projected benefit obligation $ 7,355 $ 6,187

Accumulated benefit obligation $ 6,797 $ 5,562

Fair value of plan assets $ 5,415 $ 4,386