205

P

lant and e

q

ui

p

ment

—

n

et:

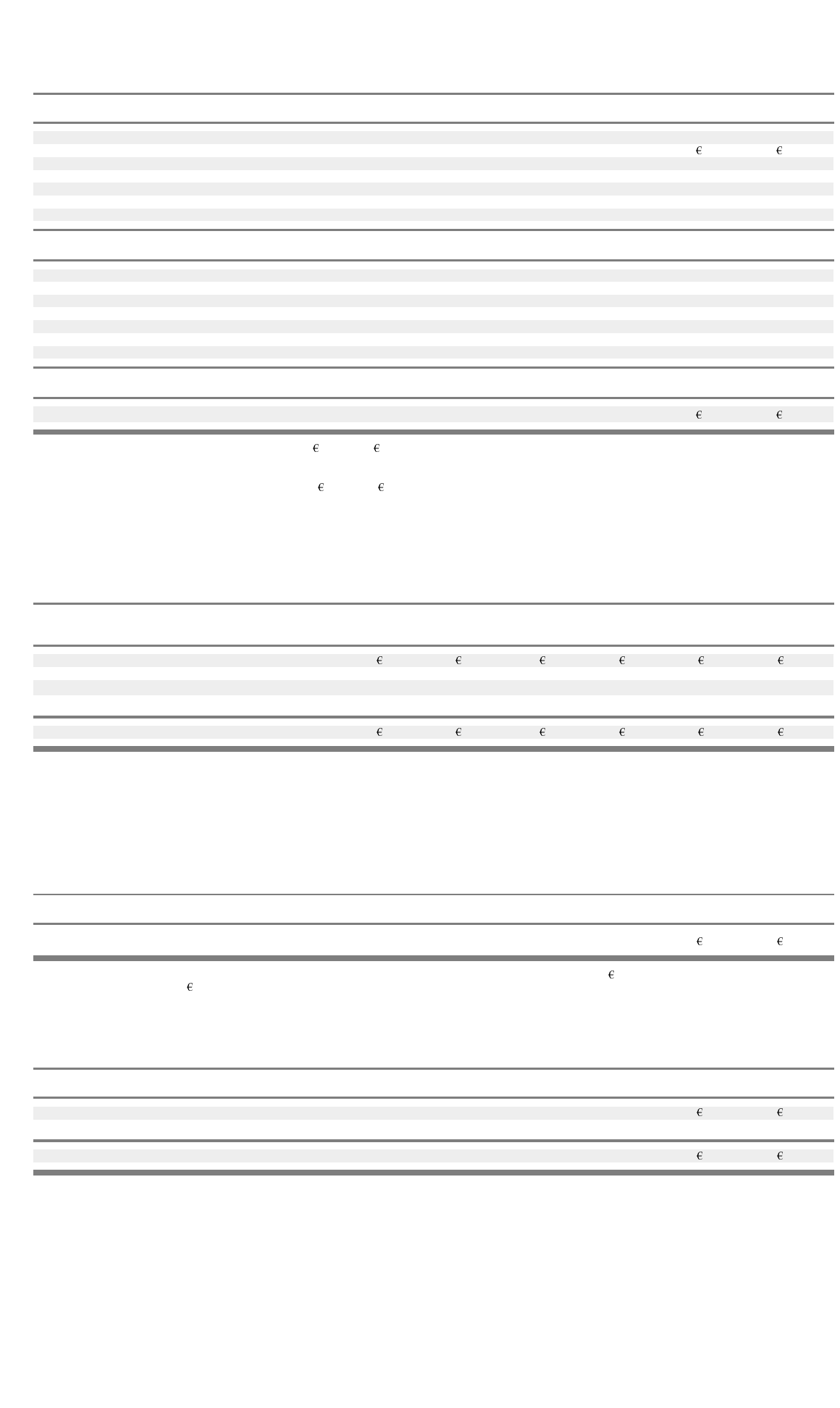

2003 2002

Cost:

Land and buildings 104,810 114,660

Leasehold improvements 31,243 38,310

Machinery and equipment 219,818 203,553

Furniture and fixtures 44,058 37,146

Com

p

uters 6,893 22,130

Other 1,430 15,885

408,252 431,684

Less accumulated de

p

reciation:

Buildings (15,943) (16,681)

Leasehold improvements (21,872) (34,356)

Machinery and equipment (141,072) (115,201)

Furniture and fixtures (38,604) (19,355)

Computers (5,700) (19,340)

Other (892) (8,630)

(224,083) (213,563)

Plant and equipment — net

(a)(b)

184,169 218,121

(a) Included assets held for sale with a carrying value of 10,897 and 14,799 as of December 31, 2003 and 2002, respectively, related to owned facilities that were

being actively marketed. These assets were written down in previous periods to their estimated fair values less costs to sell. The write downs were included in

special charges. Nortel Networks S.A. expects to dispose of all of these facilities by mid-2005.

(b) IncludedleasedassetsasrequiredbySFASNo.98of

75,927 and 79,028 as of December 31, 2003 and 2002, respectively.

Goodwill:

The following table outlines goodwill by reportable segment:

Wireless Enterprise Wireline Optical

Networks Networks Networks Networks Other Total

Balance — net as of December 31, 2001 and 2002 – –

–

– –

–

Change:

Additions

(a)

8,857 8,070 2,756 19,683

Foreign exchange – –

–

––

–

Balance — net as of December 31, 2003 – 8,857 8,070 2,756 – 19,683

(a) See note 9 for additional information.

During the year ended December 31, 2003, Nortel Networks S.A. performed its annual goodwill impairment test and concluded that there

was no impairment.

I

ntan

g

ible assets

—

n

et:

2003 2002

Other intangible assets — net

(a)

8,929 3,454

(a) Other intangible assets are being amortized over their estimated useful lives. Amortization expense is expected to be 1,020 for each of the next eight years

commencingin2004and

769 thereafter.

I

nvestment at cost

—

n

et:

2003 2002

European Aeronautic Defense & Space Telecom S.A.S – 15,871

Matra Nortel Communication Distribution S.A.S

–

305

Investment at cost — net – 16,176