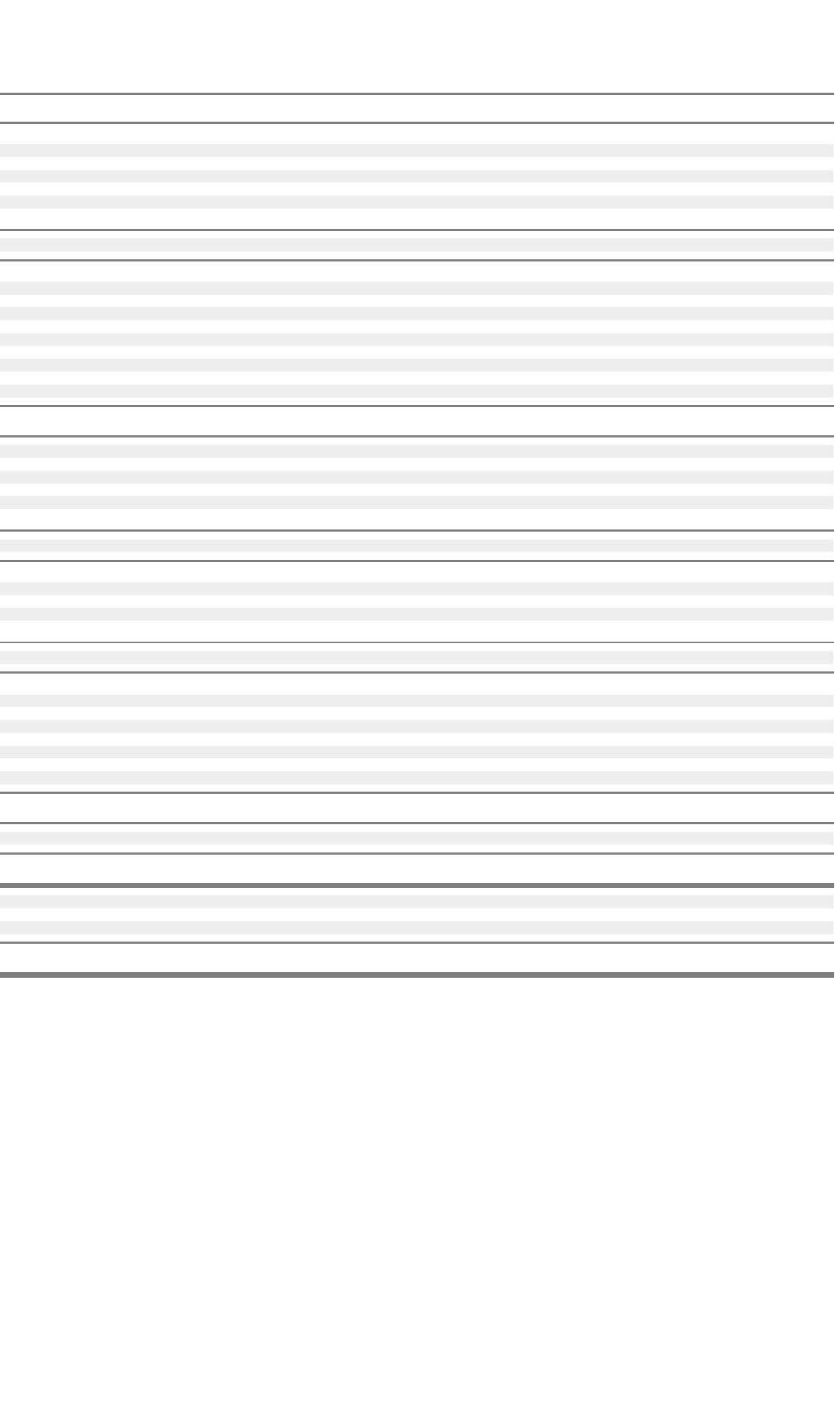

NORTEL NETWORKS CORPORATION

Consolidated Statements of Changes in Equity and Comprehensive Income (Loss)

* See note 3

The accompanying notes are an integral part of these consolidated financial statements

F-4

(millions of U.S. dollars) 2003 2002 2001

As restated * As restated *

Common shares

Balance at the beginning of the year $ 33,234 $ 32,245 $ 29,141

Common shares issued (cancelled) — net 3 863 207

Conversion of prepaid forward purchase contracts 413 1 –

Common shares issued (cancelled) related to ac

q

uisitions — ne

t

(11) (12) 2,509

Fair value and costs associated with assumed options and stock purchase plans 35 137 388

Balance at the end of the year 33,674 33,234 32,245

Additional

p

aid-in ca

p

ital

Balance at the beginning of the year 3,753 3,256 3,637

Adjustments as of January 1, 2001 due to restatement *

–

–(10)

Additions resulting from acquisition related share cancellations 11 12 10

Prepaid forward purchase contracts issued

–

623 –

Prepaid forward purchase contracts settled (413) (1) –

Fair value and costs associated with assumed options and stock purchase plans (35) (137) (401)

Stock option compensation 26 – –

Cancellation of deferred stock options (1) (13) (85)

Tax benefit associated with stock options

–

13 105

Balance at the end of the year 3,341 3,753 3,256

Deferred stock option compensation

Balance at the beginning of the year (17) (140) (413)

Adjustments as of January 1, 2001 due to restatement *

–

– (56)

Additions resulting from acquisitions

–

–(8)

Amortization of deferred stock o

p

tion com

p

ensatio

n

16 110 252

Cancellation of deferred stock options 11385

Balance at the end of the

y

ear

–

(17) (140)

Accumulated deficit

Balance at the be

g

innin

g

of the

y

ea

r

(32,966) (29,972) (2,695)

Adjustments as of January 1, 2001 due to restatement *

–

– (1,432)

Net earnings (loss) 434 (2,994) (25,722)

Dividends on common shares

–

– (123)

Balance at the end of the year (32,532) (32,966) (29,972)

Accumulated other comprehensive loss

Balance at the beginning of the year (951) (581) (499)

Adjustments as of January 1, 2001 due to restatement *

–

–189

Foreign currency translation adjustment 529 157 (134)

Unrealized gain (loss) on investments — net 57 19 (39)

Unrealized derivative gain (loss) on cash flow hedges — net 15 11 (7)

Minimum pension liability adjustment — net (188) (557) (84)

Cumulative effect of accounting change — net

–

– (7)

Other comprehensive income (loss) 413 (370) (271)

Balance at the end of the year (538) (951) (581)

Total shareholders’ equity

$ 3,945 $ 3,053 $ 4,808

Total comprehensive income (loss) for the year

Net earnings (loss) $ 434 $ (2,994) $ (25,722)

Other comprehensive income (loss) 413 (370) (271)

Total comprehensive income (loss) for the year

$ 847 $ (3,364) $ (25,993)