194

accruals and provisions and the application of accounting literature to certain matters in the Second Restatement, including revenue

recognition, foreign exchange, special charges and discontinued operations, was complicated by the passage of time, lack of availability

of supporting records and the turnover of finance personnel. As a result of this complexity, estimates and assumptions that impact both

the quantum of the various recorded adjustments and the fiscal period to which they were attributed were required in the determination of

certain of the Second Restatement adjustments. Nortel Networks S.A. believes the procedures followed in determining such estimates

were appropriate and reasonable using the best available information.

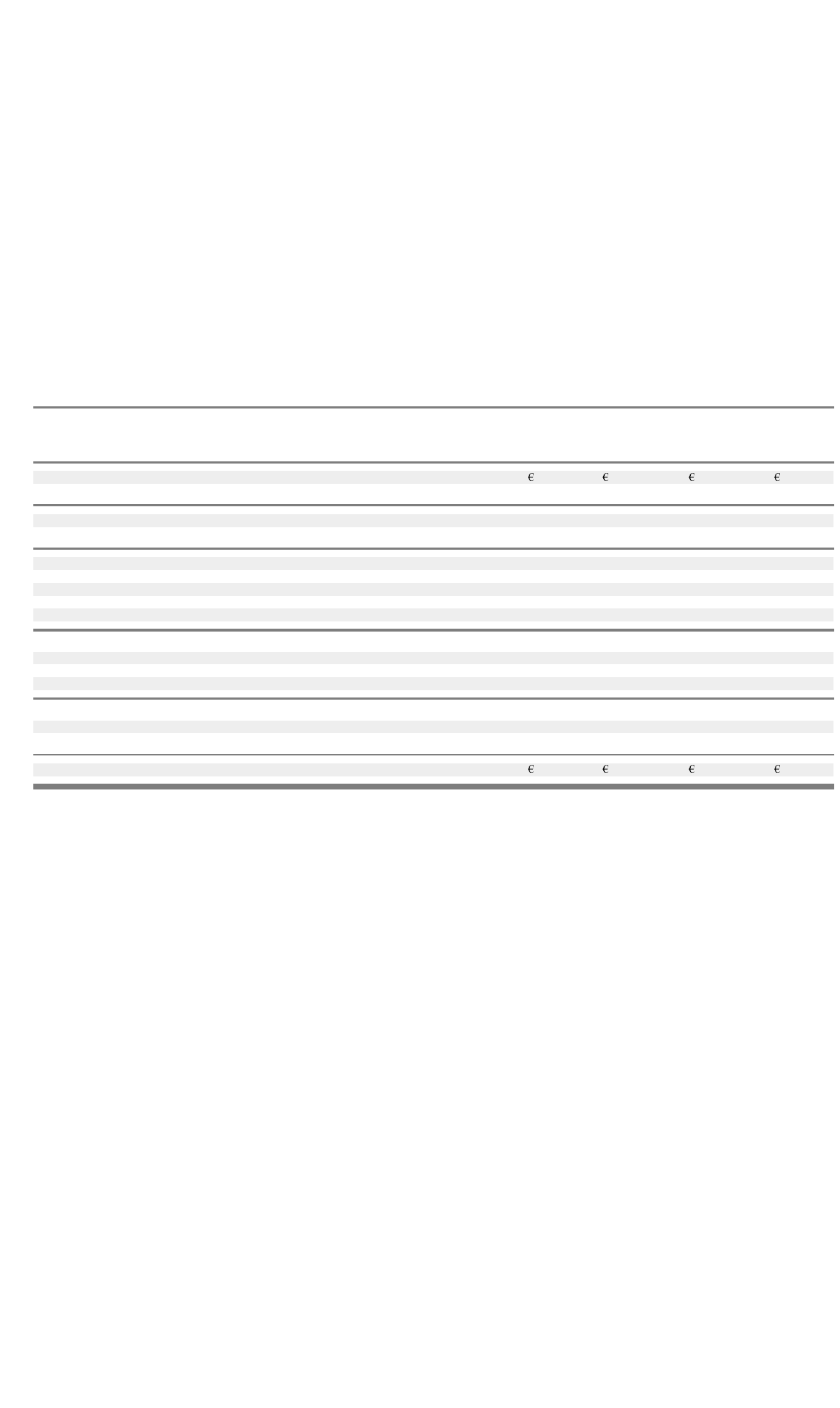

The following tables present the impact of the Second Restatement adjustments (and Pooling of Interest adjustments, see notes 2 and 9)

to Nortel Networks S.A.’s previously reported consolidated statements of operations and a summary of the adjustments from the Second

Restatement for the years ended December 31, 2002 and 2001. The Second Restatement adjustments related primarily to the following

items, each of which reflect a number of related adjustments that have been aggregated for disclosure purposes, and are described in the

paragraphs following the tables below:

• Accruals and provisions

• Related party transactions

• Plant and equipment

Consolidated Statement of O

p

erations for the

y

ear ended December 31, 2002

As Second Pooling o

f

As

previously Restatement interest pooled and

reported Adjustments Adjustments restated

Revenues — external 214,922

–

141,394 356,316

— related parties 473,223 (5,362) (8,943) 458,918

688,145 (5,362) 132,451 815,234

Cost of revenues 595,637 (45,011) 49,741 600,367

Gross profit 92,508 39,649 82,710 214,867

Selling, general and administrative expense 31,998 (3,700) 41,184 69,482

Research and development expense 257,585 6,690 – 264,275

Special charges — other special charges 58,854 2,646 21,927 83,427

(Gain) loss on sale of businesses and assets –

–

16,171 16,171

Operating earnings (loss) (255,929) 34,013 3,428 (218,488)

Other income (ex

p

enses)

—

ne

t

18,962 (1,486) 5,562 23,038

Foreign exchange gain (loss) (1,557) 331 (4,305) (5,531)

Interest expense (6,524) (3,280) (81) (9,885)

Earnings (loss) before income taxes and minority interest (245,048) 29,578 4,604 (210,866)

Minority interest — net of tax –

–

3,052 3,052

Income tax benefit 1,680

–

(40) 1,640

Net earnings (loss) (243,368) 29,578 7,616 (206,174)