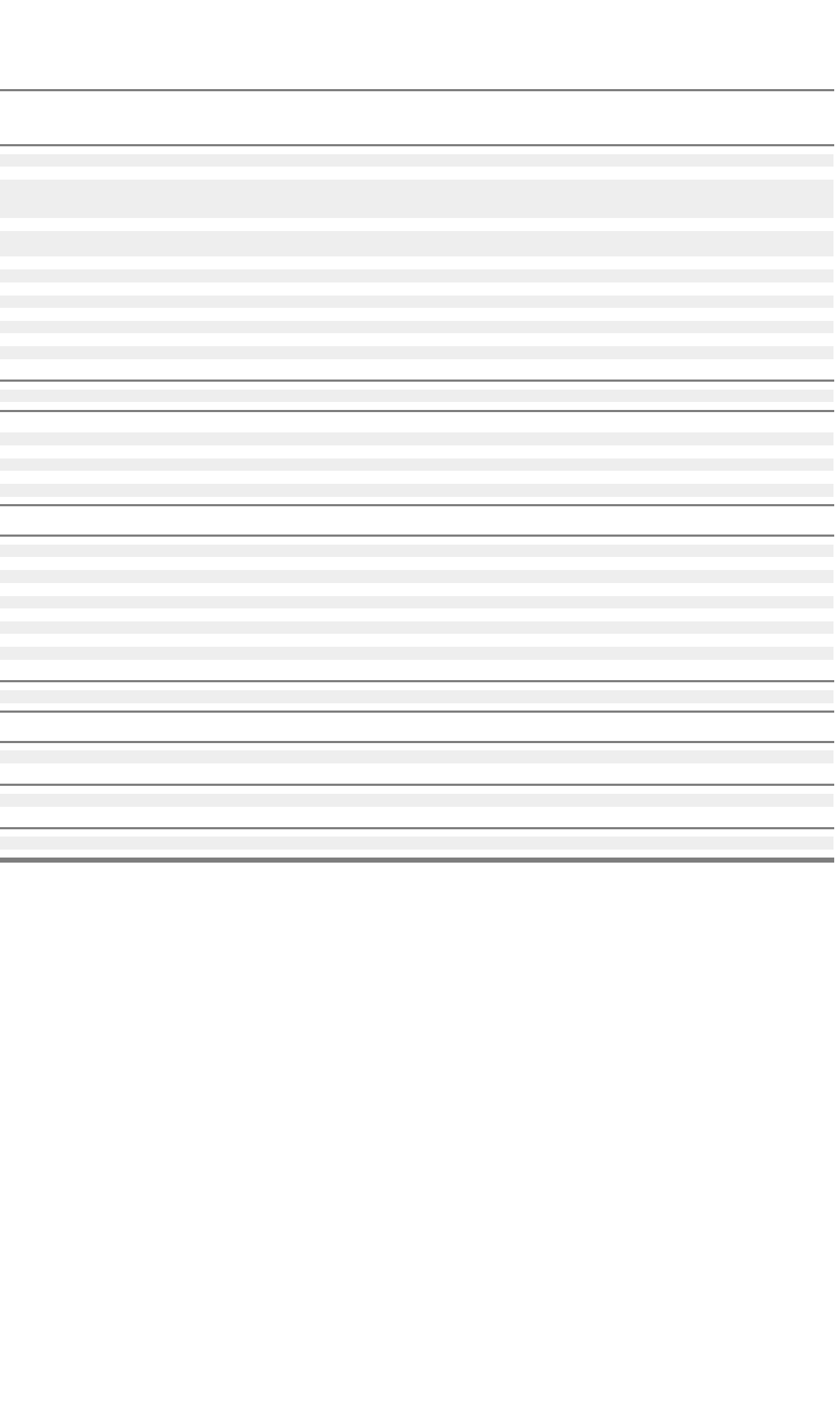

Supplemental Consolidating Statements of Cash Flows for the year ended December 31, 2002:

F-91

Nortel Nortel Non-

Networks Networks Guarantor Guarantor

(millions of U.S. dollars) Corporation Limited Subsidiaries Subsidiaries Eliminations Total

Cash flows from (used in) o

p

eratin

g

activities

Net earnings (loss) from continuing operations $ (2,893) $ (2,163) $ (1,250) $ (1,076) $ 4,489 $ (2,893)

Adjustments to reconcile net earnings (loss) from continuing

operations to net cash from (used in) operating activities, net of

effects from acquisitions and divestitures of businesses:

Amortization and depreciation – 87 402 212 – 701

Non-cash portion of special charges and related asset write

downs

– 199 464 479 – 1,142

Equity in net loss of associated companies 3,485 789 773 10 (5,040) 17

Current and deferred stock option compensation – – – 110 – 110

Deferred income taxes 16 (417) (137) 113 – (425)

Other liabilities

–

(4) 18 (16) – (2)

(Gain) loss on repurchases of outstanding debt securities – (60) –

–

–(60)

(Gain) loss on sale or write-down of investments and businesses – 17 18 (17) – 18

Other — net 64 447 (553) (175) 26 (191)

Change in operating assets and liabilities (202) (578) 904 691 – 815

Intercompany/related party activity 348 91 (152) (287) – –

Net cash from (used in) operating activities of continuing operations 818 (1,592) 487 44 (525) (768)

Cash flows from (used in) investing activities

Expenditures for plant and equipment – (65) (242) (45) – (352)

Proceeds on disposals of plant and equipment – 16 390

–

–406

Acquisitions of investments and businesses — net of cash acquired – (5) (24)

–

– (29)

Proceeds on sale of investments and businesses – 23 33 48 – 104

Investments in subsidiaries (2,287) – –

–

2,287 –

Net cash from (used in) investing activities of continuing operations (2,287) (31) 157 3 2,287 129

Cash flows from (used in) financing activities

Dividends on preferred shares – (26) –

–

26 –

Dividends paid by subsidiaries to minority interests – – –

–

(26) (26)

Decrease in notes payable — net – – (174) (159) – (333)

Proceeds from long-term debt – – 1 32 – 33

Re

p

a

y

ments of lon

g

-term deb

t

–

(460) (138) (13) – (611)

Repayments of capital leases payable – (3) (13) (1) – (17)

Issuance of common shares 863 2,287 –

–

(2,287) 863

Issuance of prepaid forward purchase contracts 623 – –

–

– 623

Stock option fair value increment – – (525)

–

525 –

Net cash from (used in) financing activities of continuing operations 1,486 1,798 (849) (141) (1,762) 532

Effect of foreign exchange rate changes on cash and cash equivalents – 13 45 16 – 74

Net cash from (used in) continuing operations 17 188 (160) (78) – (33)

Net cash from (used in) discontinued operations – 104 246 (1) – 349

Net increase (decrease) in cash and cash equivalents 17 292 86 (79) – 316

Cash and cash equivalents at beginning of year 18 (41) 2,306 1,191 – 3,474

Cash and cash equivalents at end of year $ 35 $ 251 $ 2,392 $ 1,112 $ – $ 3,790