F-34

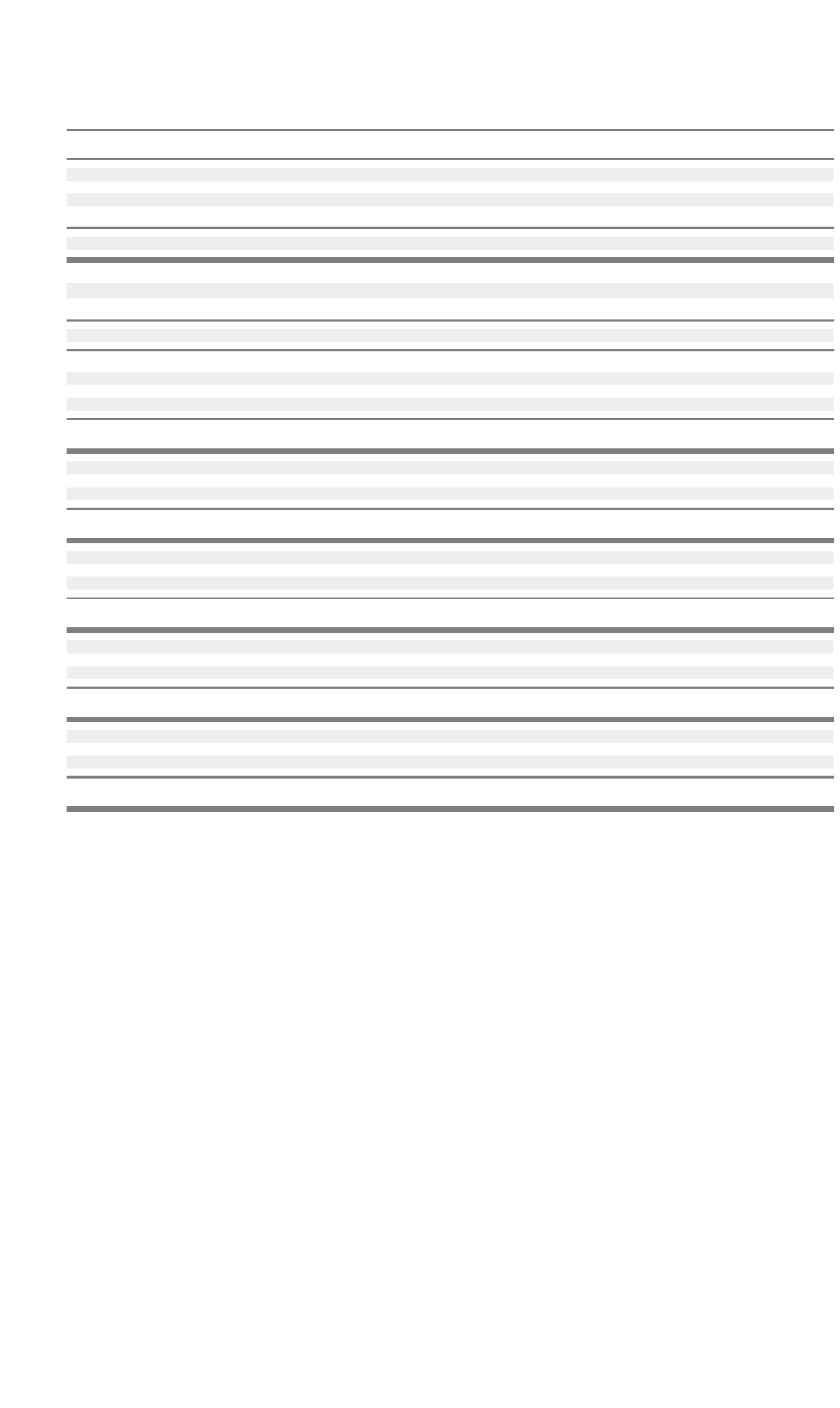

The following table presents the impact on net earnings (loss) and on basic and diluted earnings (loss) per common share for the

year ended December 31, 2001 from both continuing and discontinued operations of the SFAS 142 requirement to cease the

amortization of goodwill as if the standard had been in effect beginning January 1, 2001:

(l) Im

p

airment or dis

p

osal of lon

g

-lived assets (

p

lant and e

q

ui

p

ment and ac

q

uired technolo

gy

)

In August 2001, the FASB issued SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS

144”), which addressed financial accounting and reporting for the impairment or disposal of long-lived assets. SFAS 144 is

applicable to certain long-lived assets, including those reported as discontinued operations, and develops one accounting model for

long-lived assets to be disposed of by sale. SFAS 144 superseded SFAS No. 121, “Accounting for the Impairment of Long-lived

Assets and for Long-lived Assets to be Disposed Of”, and APB 30 for the disposal of a segment of a business. Nortel Networks

adopted the provisions of SFAS 144 effective January 1, 2002.

SFAS 144 requires that long-lived assets to be disposed of by sale be measured at the lower of carrying amount or fair value less

cost to sell, whether reported in continuing operations or in discontinued operations. Discontinued operations will no longer be

measured at net realizable value or include amounts for operating losses that have not yet been incurred. SFAS 144 also broadened

the reporting of discontinued operations to include the disposal of a component of an entity provided that the operations and cash

flows of the component will be eliminated from the ongoing operations of the entity and the entity will not have any significant

continuing involvement in the operations of the component. During the year ended December 31, 2002, Nortel Networks recorded

write downs for plant and equipment of $382 related to long-lived assets held and used, and $38 related to long-lived assets held for

sale. See note 7 for further information regarding these write downs.

2001

Reported results:

Net earnings (loss) from continuing operations $ (23,270)

Net earnings (loss) from discontinued operations — net of tax (2,467)

Cumulative effect of accounting change — net of tax 15

Net earnings (loss) — reported $ (25,722)

Adjustments:

Amortization of goodwill from continuing operations — net of tax

(a)

$ 4,067

Amortization of goodwill from discontinued operations — net of tax 195

Total net adjustments $ 4,262

Adjusted results:

Net earnings (loss) from continuing operations $ (19,203)

Net earnings (loss) from discontinued operations — net of tax (2,272)

Cumulative effect of accounting change — net of tax 15

Net earnings (loss) — adjusted $ (21,460)

Reported basic earnings (loss) per common share:

— from continuing operations $(7.30)

—

from discontinued o

p

erations (0.78)

Basic earnings (loss) per common share — reported $(8.08)

Reported diluted earnings (loss) per common share:

— from continuing operations $(7.30)

— from discontinued operations (0.78)

Diluted earnings (loss) per common share — reported $(8.08)

Adjusted basic earnings (loss) per common share:

— from continuing operations $(6.03)

— from discontinued operations (0.71)

Basic earnings (loss) per common share — adjusted $(6.74)

Adjusted diluted earnings (loss) per common share:

— from continuing operations $(6.03)

—

from discontinued o

p

erations (0.71)

Diluted earnings (loss) per common share — adjusted $(6.74)

(a) Included goodwill amortization of equity accounted investments of $9 (net of tax of $5).