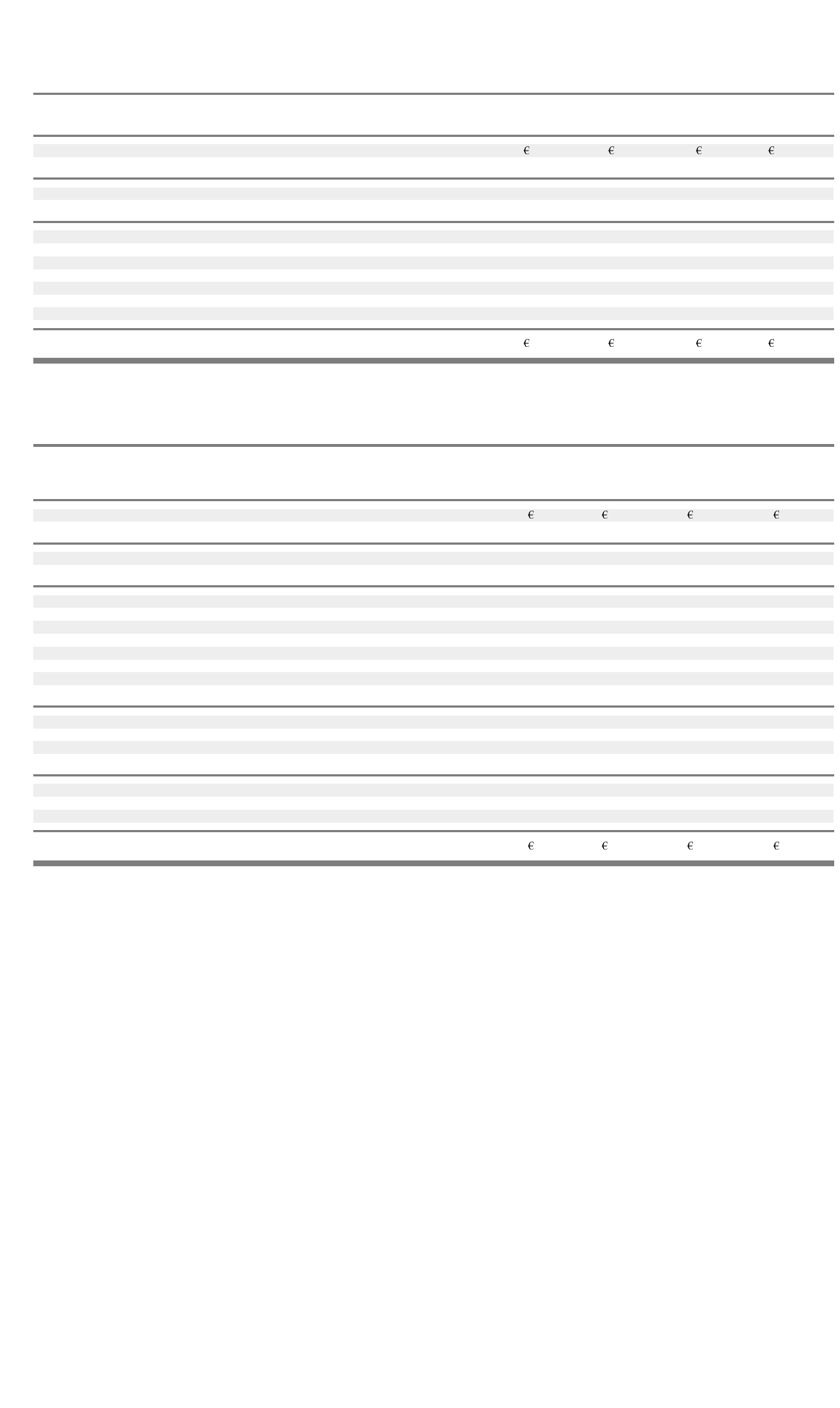

195

Summar

y

of Restatement Ad

j

ustments for the

y

ear ended December 31, 2002:

Accruals and Related party Plant and Total

provisions transactions equipment adjustments

Revenues — external

–

– – –

Revenues — related parties

–

(5,362) – (5,362)

–

(5,362) – (5,362)

Cost of revenues 9,030 (54,524) 483 (45,011)

Gross profit (9,030) 49,162 (483) 39,649

Selling, general and administrative expense (420) – (3,280) (3,700)

Research and development expense 6,690 – – 6,690

S

p

ecial char

g

es

—

other s

p

ecial char

g

es 2,646 –

–

2,646

Other income (expense) — net (1,541) 184 (129) (1,486)

Foreign exchange gain (loss) 306 25 – 331

Interest expense

–

– (3,280) (3,280)

Total restatement adjustments (19,181) 49,371 (612) 29,578

Consolidated Statements of O

p

erations for the

y

ear ended December 31, 2001

As Second Pooling o

f

As

previously Restatement interest pooled and

reported Adjustments Adjustments restated

Revenues — external 275,915 – 491,798 767,713

— related parties 429,643 9,800 (371) 439,072

705,558 9,800 491,427 1,206,785

Cost of revenues 809,472 (74,439) 381,733 1,116,766

Gross profit (loss) (103,914) 84,239 109,694 90,019

Selling, general and administrative expense 74,617 (2,876) 103,692 175,433

Research and development expense 253,327 (13,677) 9,953 249,603

Amortization of goodwill – – 3,434 3,434

Special charges

Goodwill impairment – – 20,607 20,607

Other special charges 74,463 (8,095) 8,404 74,772

(Gain) loss on sale of businesses and assets – – (10,243) (10,243)

Operating earnings (loss) (506,321) 108,887 (26,153) (423,587)

Other income (ex

p

ense)

—

ne

t

46,240 (266) 8,024 53,998

Foreign exchange gain (loss) 4,442 – (6,152) (1,710)

Interest expense (5,033) (2,821) (3,432) (11,286)

Earnings (loss) before income taxes and minority interest (460,672) 105,800 (27,713) (382,585)

Minority interest — net of tax – – 8,973 8,973

Income tax benefit 26,198 – 7,875 34,073

Net earnings (loss) (434,474) 105,800 (10,865) (339,539)